Opinion letter of 2026-27 Budget

Release Date: 2026-01-19

| Budget Consultation Support Team, | By email |

| 24/F, Central Government Offices, | budget@fstb.gov.hk |

| 2 Tim Mei Avenue, Tamar, | |

| Hong Kong |

19 January 2026

Dear The Honourable Paul Chan Mo-po, Financial Secretary, and

The Honourable Michael Wong Wai-lun, Deputy Financial Secretary

Opinion letter of 2026-27 Budget

Preamble

Hong Kong, as an international financial centre, plays a vital role in the nation's strategic framework. In the face of rapid global financial changes, regional competition, and internal structural market challenges, it is crucial for Hong Kong to consolidate its strengths and implement forward-looking policies and systemic reforms to enhance its market competitiveness, liquidity, and transparency.

This submission provides comprehensive recommendations for the 2026-27 Budget, focusing on the spot market, commodity futures market, IPO market, secondary market liquidity, asset management, virtual assets, and investor protection (including safeguarding elderly assets and collective litigation mechanisms). We believe systematic and pragmatic reforms can address market participants' needs, capitalise on strategic opportunities presented by the National 15th Five-Year Plan, and strengthen Hong Kong's unique advantages under “One Country, Two Systems.”

Spot Market

Hong Kong Stock Market Reform: Discussion on Enhancing Market Participation and Transparency

As the Hong Kong stock market develops, the soundness of market mechanisms and rules becomes increasingly important. In particular, the regulations regarding board lot sizes in Hong Kong stocks are complex, which not only limits the participation of retail investors but also affects the overall market activity. Rising entry prices make it difficult for many small investors, so the reform of board lot sizes in Hong Kong stocks urgently needs to be advanced. This article will discuss the necessity of the reform and related issues, aiming to provide a more convenient investment environment for the market.

1. Current Situation and Challenges of Hong Kong Stock Board Lot Sizes

The Hong Kong stock market has over 40 different board lot sizes. This complexity reduces the participation of retail investors and affects market liquidity. Additionally, the entry barrier for some high-priced stocks is too high. For example, Tencent requires over HKD 60,000, and Tsingtao Brewery exceeds HKD 100,000, deterring many retail investors with limited funds.

2. Suggestions for Optimizing Board Lot Sizes

The Hong Kong Stock Exchange (HKEX) recommends unifying market board lot sizes into eight categories, with the “one share per lot” model being particularly noteworthy. This aims to simplify board lot sizes, enhance trading convenience, and lower the entry barrier for retail investors. Additionally, it is suggested to set the minimum price per lot at HKD 1,000 and the maximum at HKD 50,000 to alleviate the entry pressure on retail investors.

3. Stamp Duty and Overall Transaction Costs

Currently, the stamp duty for Hong Kong stocks is 0.1%, significantly higher than in other markets, creating pressure on transaction costs. If the government can reduce or abolish the stamp duty, it will help boost market trading activity and enhance the healthy development of the capital market.

4. The Role of Regulatory Agencies

The application process of the Securities and Futures Commission (SFC) often requires a considerable amount of time, increasing costs for small and medium-sized brokerage firms and limiting their innovation capabilities. Therefore, simplifying the application process will help improve market responsiveness. Additionally, the SFC needs to provide clearer guidelines and enhance communication efficiency with brokerage firms.

5. Review of IPO Allocation Mechanisms

Under the current claw back mechanism, retail investors are allocated only 10% of the shares, while 90% goes to institutional investors. This creates an imbalance in the market structure, increasing risks for retail investors. It is recommended to increase the allocation ratio for retail investors to enhance market confidence and fairness.

The healthy development of the Hong Kong stock market requires the joint efforts of all parties, including simplifying board lot sizes, reducing transaction costs, improving regulatory processes, and promoting the market-making system. If policy adjustments can be continuously promoted, it will create a more efficient and transparent investment environment for investors. It is hoped that the government will advance reforms in the Hong Kong securities market, making it more attractive and competitive.

Commodity Futures Market

Since the Hong Kong Special Administrative Region Government proposed a clear strategic plan in 2024 to develop Hong Kong into a commodity futures hub and has been advancing several key measures, it has been nearly two years since the proposal, yet various policies have still not been implemented or finalized. The progress has indeed been somewhat slow.

Our association is also pleased to note that, at the strategic level, the government established a high-level planning committee toward the end of 2025. The “Strategic Committee on Commodities,” led by the Financial Secretary, held its first meeting on December 22, 2025.

We hope the government will conduct comprehensive research on global market trends and provide specific recommendations and a development blueprint for the positioning, development, and promotion strategies of Hong Kong’s commodity market.

To accelerate policy implementation, our association reiterates the following recommendations regarding commodity futures policies in the relevant budget:

Development of the Precious Metals Market

The precious metals market was one of the hottest markets in 2025, with various precious metals experiencing remarkable surges in prices. In particular, gold prices repeatedly reached historic highs, rising from $2,624 per ounce (December 31, 2024) to $4,322 per ounce (December 31, 2025), an annual increase of 64.7%, marking the largest annual gain in 46 years. However, Hong Kong’s trading volume in precious metals commodity futures contracts and spot gold clearly did not keep pace with this significant upward trend during the year.

Our association believes that the government should take the lead and collaborate with the precious metals industry to promote the establishment of an exchange trading platform for spot and futures precious metals. This platform should feature more transparent systems and regulations, as well as enhanced warehousing and delivery capabilities, to encourage greater participation in Hong Kong’s precious metals market and improve the competitiveness of Hong Kong’s gold and commodity markets.

Infrastructure Development

An active futures market requires a deep spot market, delivery warehouses, and other infrastructure as its foundation. This necessitates supporting talent in areas such as warehousing and logistics, quality certification, and financial technology (e.g., blockchain for transaction traceability).

Over the past two years, our association has repeatedly proposed enhancing Hong Kong’s warehousing and delivery capabilities for precious metals. For example, the London Metal Exchange (LME, which is part of Hong Kong Exchanges and Clearing Limited), local commodity futures industry players, and warehouse operators all hope that Hong Kong can become an LME-approved warehouse and be included in its globally authorized delivery locations, thereby consolidating Hong Kong’s position as a physical commodity settlement hub.

Tax Reform

Our association hopes that the government can provide tax incentives for commodity traders, such as implementing a 50% tax reduction for eligible commodity traders. In addition, industry groups like ours have proposed broader recommendations during the budget consultation period, including reforming the financial transaction tax system. These recommendations include adjusting the stamp duty on stock transactions and providing clearer, more competitive tax arrangements for derivative commodity trading to comprehensively enhance the vitality of Hong Kong’s financial market.

Talent Support Policies

While the government aims to establish Hong Kong as an international commodity settlement hub, developing Hong Kong into an international commodity futures center faces key challenges that require talent support for breakthroughs. Hong Kong’s futures market is predominantly focused on financial derivatives, while the development of commodity futures is relatively lagging.

The market requires versatile talents who are proficient in both spot commodity trading and derivative product design and risk management to develop and promote a more diverse range of commodity futures products. Therefore, the government should focus on nurturing local commodity futures professionals while also implementing preferential policies, such as tax reductions and talent attraction programs, to encourage commodity futures companies and talents to establish themselves in Hong Kong. This will help address market shortcomings, seize national development opportunities, and ultimately build an international commodity futures hub.

Deepening Interconnectivity with Mainland China

Leveraging the opportunities presented by the national development during the 15th Five-Year Plan period is Hong Kong’s greatest advantage in attracting and cultivating international talent. Interconnectivity with the mainland market creates job opportunities, and the industry widely anticipates the establishment of a “Commodity Connect” mechanism similar to “Bond Connect” and “Stock Index Futures Connect” in the future. The “National Treasury Bond Futures” and “Futures Connect,” currently under preparation and study, are hoped to be implemented as soon as possible, which would greatly promote cross-border capital market interconnectivity between the two regions. These new mechanisms will require a large number of multinational financial professionals familiar with the regulatory frameworks, markets, and products of both regions.

Attracting Specialists Through Physical Project Implementation: For example, the Shanghai Gold Exchange establishing an offshore warehouse in Hong Kong would not only bring spot trading but also attract talent across the industrial chain, including warehousing management, clearing, and risk management.

As the world’s largest offshore RMB center, Hong Kong is actively enriching RMB-denominated investment and risk management tools. This urgently requires product experts familiar with RMB internationalization business and derivative product design.

In summary, our association hopes that the new budget will outline a systematic blueprint for the development of Hong Kong’s commodity futures market, focusing on high-level planning, ecosystem development, and tax incentives. Its effectiveness will depend on the speed of subsequent implementation of specific measures and breakthroughs in interconnectivity with the mainland market.

IPO Market

In response to the current issues of the “fast-track culture” in IPOs and the declining quality of application documents, this association recommends linking capital market development measures with “investor protection + intermediary responsibility + market capacity management” to prevent investment banks from solely pursuing fundraising amounts and rankings.

Institutionalization of Regulatory Framework and Resource Capacity

- It is recommended that the Financial Services and the Treasury Bureau take the lead, in collaboration with the Hong Kong Securities and Futures Commission and the Hong Kong Stock Exchange, to review the regulatory framework for sponsor resource allocation. The practical regulatory expectation that “each Principle concurrently handles approximately 2 to 3 active IPO applications” should be elevated to clear written guidelines and considered for inclusion in the Code of Conduct or guideline-level documents.

- It is recommended that the budget allocate resources to the Hong Kong Securities and Futures Commission to establish a dedicated task force. This task force would regularly and quantitatively monitor the project workload of licensed sponsor institutions (including large-scale A+H new stock listings). Once the workload exceeds the guideline limits, a tiered penalty mechanism should be triggered, including measures such as “suspending acceptance of new projects,” “mandatory rectification plans,” or even “suspending sponsor qualifications.”

- Given the current concentration of a large number of simultaneous A+H listings and oversize new stock offerings among a few leading Chinese securities firms and law firms, the budget should require regulatory bodies to review the risks associated with “project concentration.” Additionally, it should explore the need to establish a “soft cap” on the number of simultaneous large-scale IPOs handled by the same institution or impose stricter requirements for substantive participation evidence.

Rethinking the Future of Hong Kong's IPO Market

As an international financial center, the vitality and quality of Hong Kong's capital market have always been built upon a sound system, rigorous regulation, and the professional integrity of market participants. However, the recent rare joint letter from regulators and market operators to all sponsors, expressing deep concern over the declining quality and non-compliant practices in new listing application documents, reveals that beneath the surface prosperity of the market, some deep-seated structural issues have quietly emerged. Regarding these phenomena, We believe it is necessary to combine public data and industry observations to objectively analyze this situation and offer constructive suggestions on regulatory and operational directions.

I. High Concentration in the Sponsor Market: Potential Risks and the Breakdown of “Unwritten Rules”

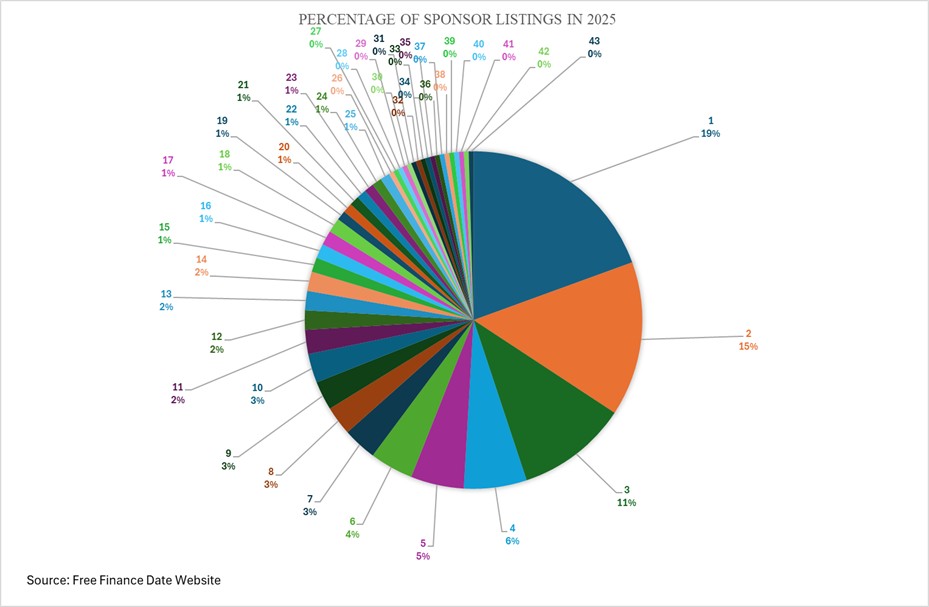

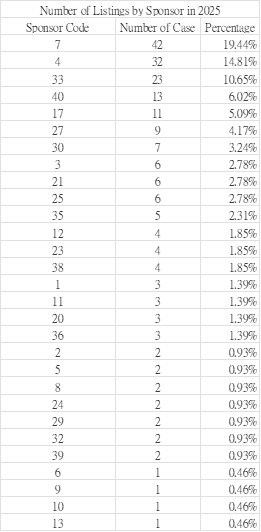

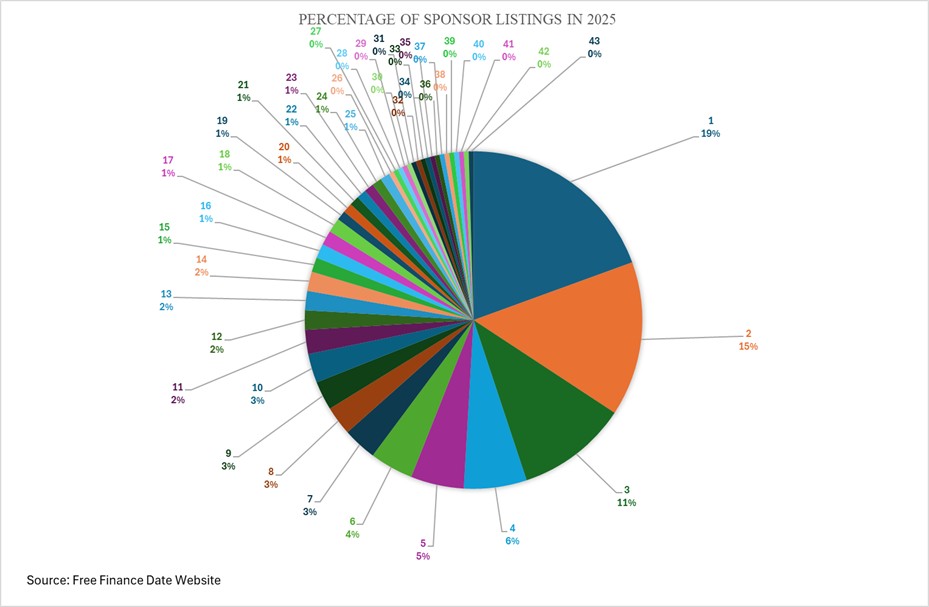

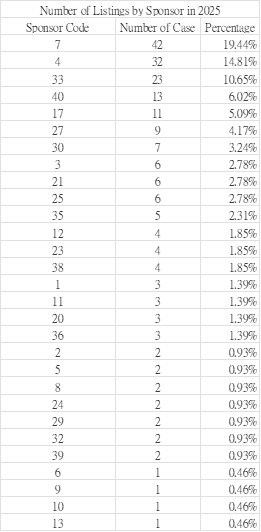

According to public data up to the end of 2025, the total number of sponsor-led listing projects for the year was 216. A concerning phenomenon is the extreme concentration of market share among top-tier institutions. The top 4 sponsors handled a combined total of 108 listing projects, exactly 50% of the annual total. This means the remaining approximately 40 active sponsor institutions shared the other half of the market.

Chart 1: Percentage of Sponsor Listings in 2025

Chart 2: Number of Listings by Sponsor in 2025

Chart 2: Number of Listings by Sponsor in 2025

This high degree of concentration is not inherently problematic, but in the current context, it exacerbates risks. The industry has long operated with an "unwritten rule": to ensure work quality and thorough due diligence, a single sponsor team should avoid handling an excessive number of projects concurrently. Some hold the view that undertaking more than 3 major sponsorship projects simultaneously approaches the reasonable limit of workload capacity. Viewed through this lens, the average number of projects handled annually by the aforementioned top four sponsors far exceeds this figure, highlighting the intensity of their workload and the extent of resource dilution. This aligns with the industry reality frequently reported in various media outlets: senior personnel "overseeing multiple cases," junior or inexperienced staff handling foundational work, and even interns participating in critical processes. When a sponsor's professional attention is excessively diluted, the emergence of low-level errors in listing documents, such as "sloppy work," "copy-pasting," and a lack of understanding of basic facts, becomes almost inevitable.

It is undoubtedly correct for the regulatory authorities to directly address in their letter the sponsors' failure in their duties and the poor quality of materials. However, all sponsor-led listing applications require approval from regulators and market operators before proceeding to listing. Does the sight of a well-known sponsor's name make approval easier? No one knows. Nevertheless, should regulators also reflect on whether, during the market's rapid expansion—where application numbers surged from about 100 at the beginning of the year to nearly 400 (counting only listing counts)—there was a lack of forward-looking risk warnings and adjustments regarding this phenomenon of market concentration leading to sponsor overcapacity? Does the widespread breakdown of the "unwritten rule" indicate the necessity of formalizing and imposing rigid constraints? For example, consider introducing guidance based on the number and experience of a sponsor's core team members, setting a "simultaneous project undertaking cap," or linking project load to compliance records. This would create a mechanism to prevent institutions from sacrificing professional standards in pursuit of market share.

II. Poor Performance of New Listings: A Crisis of Market Confidence Behind the Data

While regulatory focus is on document quality, the market ultimately tests the performance of listed companies. Data from 2025 shows that among the 216 sponsor-led listing projects, 55 projects fell below their offer price on the first trading day, representing a high ratio of 25.5%. The largest first-day drop reached 49%. Extending the timeframe to the end of 2025, the cumulative number of projects falling below their offer price increased to 89, accounting for 41.2%, with the largest cumulative drop reaching 73%. These cold, hard numbers speak louder than any rhetoric: a large number of new listings have failed to create value for investors, even causing significant losses.

Admittedly, new listings breaking issue price are influenced by multiple factors, such as overpricing, market sentiment, and underwriting strategies. However, when such a high proportion of new listings perform poorly, occurring concurrently with declining listing document quality and sponsor overwork, it is difficult to view these as isolated phenomena. This directly erodes the confidence and trust of the broader investor base, especially retail investors, in Hong Kong's new listing market. Former Financial Secretary Mr. John Tsang has also expressed concern over the recent sharp declines of several new listings upon debut, questioning whether "some work has been done carelessly or inadequately," a pointed observation.

III. The Unintended Consequences of Reform Measures: The Case of FINI and the Claw back Mechanism

In recent years, several reforms aimed at enhancing efficiency and international competitiveness have been implemented in the Hong Kong stock market, but their actual effects have deviated, to some extent exacerbating the current turmoil.

Firstly, there is the FINI platform launched in November 2023. It significantly shortened the IPO settlement cycle from T+5 to T+2, with the original intent of improving efficiency and reducing capital lock-up costs. However, as payment is required only after share allocation, this system, lacking corresponding checks and balances, has been exploited by some market participants. Investors can subscribe in large quantities at nearly "zero cost," leading to oversubscription multiples often reaching hundreds or even thousands of times, creating a false impression of exceptionally high market demand. This "air subscription" distorts the true supply-demand relationship, potentially leading to pricing distortions and rapid price drops after listing due to a lack of genuine buy-side support.

Secondly, there is the new claw back mechanism. This mechanism substantially reduces the proportion of shares allocated to the public offering tranche (retail investors) in cases of oversubscription. While the intention might have been to optimize share allocation structure, in practice, it can easily lead to extreme "cornering of shares," where a large portion of shares is concentrated in the hands of a few international placement investors. In the initial listing period, with scarce floating stock and a severe supply-demand imbalance, share prices may be artificially inflated, creating a brief "surge" illusion. However, this distorted start not only harms market pricing efficiency but also discourages or exposes ordinary investors entering the secondary market later to extremely high risks, damaging market liquidity and health in the long run.

The root cause of these problems stemming from reforms may lie in policy design and the consultation process. Critics have pointed out that during the relevant public consultation phases, market operators and decision-makers may have had preconceived notions, failing to adequately listen to and balance the deep-seated concerns of various market participants, especially warnings about potential loopholes. This led to issues emerging after the "forceful implementation." This inevitably raises questions about perceived bias or favoritism (playing favorites, favor to big cap, discrimination to small cap). While regulators strictly demand sponsors improve document quality, should they also take responsibility for reviewing and optimizing system designs under their purview that may exacerbate market distortions and risks?

IV. Talent Gap and the Systemic Responsibility of Regulation

The market's rapid expansion has exposed a shortfall in talent reserves. During the pandemic downturn, many experienced professionals left the industry. When the market heated up, institutions rapidly expanded hiring, but many recruits brought in from overseas were newcomers unfamiliar with Hong Kong's listing rules and market environment. The transmission of professional experience suffered a disconnect. "Veterans overseeing, novices executing" became the norm, making it difficult to ensure work quality. The regulator's letter highlighting sponsors' "lack of understanding of the basic facts of listing projects" is a direct consequence of this talent structure imbalance.

Faced with this situation, regulatory authorities should not limit their focus to the level of "post-facto accountability" for sponsors. They should also consider how to promote the rebuilding of a professional talent pipeline at a systemic level, encouraging institutions to establish sustainable talent development mechanisms rather than merely "fishing in a depleted pond" during market booms. Furthermore, avoid interfering with market salary levels to attract experienced sponsors back to the industry.

V. The Socio-Economic Responsibility and Local Contribution of Listed Companies

While many companies have recently listed in Hong Kong to raise capital, contributing to capital market activity, it is also essential to consider their contribution to Hong Kong's real economy. The SAR Government should create conditions to actively encourage these newly listed companies to establish a presence in Hong Kong, set up substantial operations, and hire more local employees, creating more quality job opportunities for citizens. When more people have stable jobs and improved incomes, local consumption will naturally increase, driving the recovery of retail, catering, service, and other sectors. Consequently, reduced cross-border spending to the north would boost local commercial activities, benefiting shop rentals and the property market, forming a virtuous cycle that promotes social harmony and economic stability. This is not only an objective of market development but also the inherent duty of the capital market to serve society and build shared prosperity.

Rebalancing and Protecting the "Golden Reputation"

Hong Kong's capital market's "golden reputation" was forged by generations of professionals through their expertise, integrity, and diligence. The problems currently exposed in the market are warning signs of imbalances between "speed" and "quality," "innovation" and "stability," and "market vitality" and "investor protection."

The regulatory authorities' issuance of the letter is a necessary corrective action. However, the next step should move beyond case-by-case warnings toward systemic governance:

1. Study formalizing sponsor workload management, establishing reasonable concurrent project handling guidelines to alleviate quality pressure at the source.

2. Conduct a comprehensive review of the actual operational effects of new mechanisms like FINI and the clawback, plugging loopholes to prevent system abuse and market distortion.

3. Assume a guiding responsibility in talent cultivation, working with the industry to address the professional experience gap.

4. Ensure an open and balanced policy-making process, humbly listening to criticisms and suggestions from all market sectors to avoid planting hidden risks due to bias.

5. Promote local contribution from listed companies, encouraging them to establish operations and create jobs in Hong Kong, leveraging the capital market's positive role in the real economy and social stability.

Only when decision-makers, regulators, market operators, sponsors, and other intermediaries each fulfill their roles while working collaboratively—pursuing market efficiency and scale while steadfastly upholding the bottom lines of quality and fairness—can order be restored from chaos. This will enable Hong Kong's IPO market to truly transition from "quantity-driven" to "quality-driven," consolidating and polishing our hard-earned reputation as an international financial center. This is not only a responsibility to history but also a commitment to the future and the next generation. Although the road ahead is challenging, by returning to professional fundamentals, upholding integrity while innovating, Hong Kong's capital market will surely navigate through cycles and continue to write its glorious chapter.

Policy Recommendations for Optimizing the Depth of Hong Kong's Secondary Stock Market

Reflecting on 2025, Hong Kong stocks performed exceptionally well, and the performance of the new stock market also rode this wave of success. According to statistics from Hong Kong Exchanges and Clearing Limited (HKEX), as of December 30, 2025, a total of 119 companies listed in Hong Kong, raising over HKD 285.8 billion. Among these, four companies ranked among the world's top ten IPOs in 2025. Hong Kong's IPO fundraising ranking returned to the top globally for the first time since 2019. This overall growth was primarily driven by the surge in A+H listings, with related projects accounting for half of the total IPO funds raised for the year. Hong Kong completed 19 A+H listings within the year, the highest number ever. This not only attracted a large number of enterprises in hard tech and biopharmaceutical sectors to list in Hong Kong, aligning with the "14th Five-Year Plan's" key focus on using financial support to consolidate and strengthen the real economy and foster emerging and future industries (such as artificial intelligence, low-altitude economy, quantum technology, bio-manufacturing, etc.). It also further promotes the continuous inflow of international long-term capital and southbound funds, reshaping the capital ecosystem of the Hong Kong stock market and further verifying Hong Kong's unique advantage as a bridge connecting the mainland and international capital markets.

In 2025, HKEX and relevant mainland departments had already introduced multiple measures to optimize the process for A-share companies to issue additional H-shares in Hong Kong. These measures focused on key areas such as lowering issuance thresholds, accelerating approval processes, and facilitating fund management, as detailed below:

1. Lowering the Mandatory Thresholds for H-share Issuance: Towards the end of 2024, HKEX proposed consultation suggestions to lower the minimum proportion threshold for A-share companies issuing H-shares in Hong Kong from 15% of the issued shares of the same class to 10%. Concurrently, an alternative market capitalization threshold was proposed: if the expected market capitalization of the H-shares at the time of listing is at least HKD 3 billion and held by the public, it could also satisfy the requirement. This can reduce the equity dilution pressure for A-share companies when issuing additional H-shares and lower the demand for large-scale capital issuance.

2. Significantly Simplifying the Listing Approval Process: Starting October 2024, eligible A-share companies applying for listing in Hong Kong can enjoy fast-track approval. Among them, companies with an estimated market capitalization ≥ HKD 10 billion and compliant over the last two full financial years will receive only one round of regulatory comments and complete the assessment within 30 business days. Other A-share companies will receive a maximum of two rounds of regulatory comments and complete the assessment within 40 business days, shortening the review time compared to the past.

3. Optimizing Cross-border Fund Management Rules: In December 2025, the People's Bank of China and the State Administration of Foreign Exchange jointly issued the "Notice on Issues Related to Fund Management for Overseas Listings of Domestic Enterprises." It clarified that funds raised from H-share issuances by A-share companies, as well as proceeds from share reductions, can be remitted back to the mainland in either RMB or foreign currency at the enterprise's discretion. If overseas investment registration has been completed, raised funds can also be retained for direct use overseas without mandatory repatriation. Furthermore, foreign currency funds raised can be settled into RMB independently, significantly simplifying cross-border fund usage procedures.

These measures effectively facilitated a large number of A-share companies to issue H-share IPOs in Hong Kong, helping the Hong Kong stock market raise over HKD 285.8 billion in 2025 and regain the top global spot after 6 years. However, facing a large number of new H-share issuances and new company listings, we observed that for many newly listed stocks, trading volume significantly decreases one month after listing. This leads to reduced investor willingness to purchase these stocks, and shareholders holding these stocks face considerable difficulties in selling them on the market to realize gains. If we want to enhance the international competitiveness of the Hong Kong stock market and attract more and better enterprises and investors to choose Hong Kong, one crucial metric directly points to the issue of local market trading volume and liquidity. Citing the Hong Kong Financial Services Development Council's report published in December 2025 titled " Hong Kong’s Capital Market Leadership: A Super-Connector Path to the Global Capital Nexus in the Digital Era" (the "FSDC Report"), the following is an excerpt: "...start with the segment where many small and medium-sized issuers often stagnate: secondary market liquidity. When trading is sparse, bid-ask spreads widen, institutional investors' willingness to participate declines, and valuations become suppressed. The result is increased issuance costs and weakened willingness for future refinancing..."

While we focus on strong IPO fundraising, we must also consider further boosting trading volume and liquidity to strengthen the global competitiveness of the Hong Kong stock market. A major factor affecting trading volume is participation cost. Correctly assessing the burden of transaction costs and effectively reducing costs for market participants can help drive more market trading.

Currently, in the mainland China stock market, the stamp duty on stock transactions is levied only on the selling side for certain transactions, with clear distinctions in tax rates for different trading products. The current rules as of 2025 are as follows:

1. Main Board, GEM, A-shares: The tax rate is 0.1% (one-thousandth) of the transaction amount, levied only on sales.

2. Cross-border Securities Trading (e.g., Shanghai-Hong Kong Stock Connect, Shenzhen-Hong Kong Stock Connect): When mainland investors participate, the tax rate follows the corresponding market standards. For Hong Kong stock trading, it is typically 0.1% and levied on both sides (buy and sell).

3. Preference Shares, Convertible Bonds: These fall under categories exempt from stock transaction stamp duty; no stamp duty is required for transactions.

Currently, Hong Kong stock transaction stamp duty applies uniformly to all Hong Kong-listed shares, including H-shares. It is recommended to reduce the stamp duty gap with the mainland A-share market by further implementing a reduction of the stamp duty rate for Hong Kong-listed company share transactions to 0.05% on both the buy and sell sides. This would result in a total stamp duty of 0.1% per round-trip transaction, aligning with the mainland China A-share market standard. Simply put, trading volume has significant price elasticity in response to reductions in transaction costs, particularly for smaller-scale and less liquid issuers. Furthermore, for issuers with chronically low turnover (e.g., below a transparent threshold, such as being in the bottom 25th percentile of total turnover over the past 12 months), their historical stamp duty contribution is already quite limited. Introducing conditional exemptions, such as waiving stamp duty for a stock's trades in the subsequent fiscal year if its turnover rate falls below a benchmark, could be considered. The hope is that stamp duty relief will stimulate trading in stocks with lower liquidity.

Finally, concluding with another excerpt from the FSDC Report: "...the goal is to create a virtuous cycle: better liquidity helps lower the cost of capital, encouraging companies to maintain their listing status and return to the market for fundraising; deeper market participation helps improve valuations and broaden the shareholder base; simultaneously, Hong Kong can further consolidate its position as the preferred listing venue for small and medium-sized issuers with high growth potential in the region..."

Since the new listing rule reforms introduced in 2023 successfully stimulated the rigid demand for A-share companies to issue H-share IPOs in Hong Kong, 2024 should focus on consolidating this growth momentum, promoting stock trading activity, expanding the overall market size, further attracting capital inflows into the Hong Kong stock market, enhancing the liquidity of Hong Kong's secondary stock market, and improving competitiveness in the international financial market!

Asset Management

As the global financial market continues to evolve, Hong Kong's position as an international financial center faces numerous challenges. The asset management industry, a crucial pillar of Hong Kong's financial system, not only impacts economic growth but also directly influences investor confidence. Although Hong Kong's asset management industry has achieved some success in recent years, with asset sizes increasing and attracting substantial foreign investment, this surface prosperity masks deeper issues within the industry.

Lagging Regulatory Environment

The current regulatory framework has failed to keep pace with the rapid changes in the industry. Many asset management companies face cumbersome compliance requirements, which not only increase operational costs but also make it difficult for many small firms to survive. Excessive regulation stifles innovation. The government should continuously optimize the regulatory framework to create a more flexible operating environment, enabling businesses to develop more effectively.

Lagging Technological Transformation

Amid the rapid development of fintech, many of Hong Kong's asset management companies remain entrenched in traditional models and have failed to fully leverage digital tools to enhance efficiency and reduce costs. If these companies do not accelerate their digital transformation, they will lose their competitive edge in the future market and may ultimately be phased out.

Outdated Tax System, Stifling Competitiveness

While Hong Kong's tax incentives sound attractive, they are, in reality, uncompetitive. For example, the expansion of the tax concession for carried interest for private funds in 2025 has stringent conditions, applying only to specific funds, and the tax rate remains higher than Singapore's tempting zero-tax regime. The result is that more high-net-worth individuals and fund managers are choosing to relocate to Singapore. Although Hong Kong's family office growth is rapid, it still falls short of expectations. Without significantly reducing fund tax rates, Hong Kong will never be able to match global competitors.

Urgent Recommendations: Concrete Actions Needed

In response to the issues above, Hong Kong's asset management industry urgently requires concrete actions. The following are several critical recommendations:

1. Restructure the Regulatory Framework

The government should appropriately relax regulations for asset management companies, especially for small firms, by providing more flexible regulatory measures. This would not only ease the burden on small companies but also promote market competition and enhance overall industry efficiency.

2. Promote Technological Innovation

Increase support for fintech by establishing dedicated funds to encourage technological investment by asset management companies. Simultaneously, promote collaboration within the industry and encourage technology sharing among enterprises to elevate overall technological standards.

3. Regularly Evaluate and Adjust Policies

Regulatory bodies should establish a regular evaluation mechanism to adjust policies promptly based on market changes, thereby maintaining regulatory flexibility and adaptability. This is essential for better responding to dynamic market shifts and protecting investor interests.

4. Optimize the Tax System to Enhance Competitiveness

In terms of the tax system, sweeping reforms are necessary. Introducing a zero-tax rate for carried interest concessions, covering all private equity and hedge funds, is crucial to attract more international capital and talent.

The Path Forward

Hong Kong's asset management industry holds an irreplaceable position in the international financial market. However, without timely reforms, future challenges will only intensify. The government must recognize the industry's current state and adopt practical and feasible measures to address these challenges. Otherwise, Hong Kong will struggle to maintain its status as a global asset management center. This is not only a crisis for the industry but also for Hong Kong's entire economy and must be taken seriously by all sectors. Only through substantive reforms can Hong Kong secure its place in global financial competition and meet future challenges.

Virtual Currency Market

A Critical Turning Point Entering the "Post-Licensing Era"

As the 2026-27 fiscal year approaches, Hong Kong's Web3 development stands at a critical juncture. Looking back, with the SFC actively advancing the A-S-P-I-Re roadmap, Hong Kong's regulatory framework for virtual assets has matured significantly. Looking ahead to 2026, we are about to witness the implementation and refinement of the licensing system for virtual asset trading and custody, alongside the formal issuance of the first batch of fiat-referenced stablecoin licenses. This marks Hong Kong's successful completion of the "building nests to attract phoenixes" phase—establishing the foundational regulatory infrastructure.

However, compliance is merely the entry ticket; liquidity and application are the lifelines of the market. In the 2026-27 fiscal year budget, the government's strategic focus should fully transition from the "infrastructure construction" of the past few years to "commercial application implementation." This association's proposal advocates for using precise fiscal measures to leverage traditional financial intermediaries to unlock market liquidity, incentivize R&D for settlement efficiency applications, rapidly enhance the professional skills of existing financial practitioners, and closely align the interests of the government, banks, exchanges, and brokerages.

I. Stimulating Liquidity: Breaking the "Silo Effect" of RWAs

Real World Asset (RWA) tokenization is seen as the next trillion-dollar track in Web3. However, the market currently faces the core issue of insufficient liquidity. Without secondary market liquidity, tokenized assets are merely static data on the blockchain, unable to fulfill price discovery or enhance capital efficiency. We must bridge the "last mile" between virtual asset trading platforms (VATPs) and the broader investor base.

Therefore, the new budget should prioritize "building a secondary market for RWAs."

Facilitating the Fiat-Asset Cycle: The government should provide specific incentives to encourage licensed Virtual Asset Trading Platforms (VATPs) to integrate RWA products and establish direct conversion channels (on-ramps) with licensed stablecoins. This will not only inject retail capital into RWAs but also provide a practical application outlet for HKD stablecoins in real financial scenarios, creating a virtuous internal cycle of "stablecoin payment – RWA investment."

Integrating Traditional Brokerages into the Interest Community: Introduce technology upgrade subsidies for licensed corporations under Type 1 regulated activity (dealing in securities), encouraging brokerages to upgrade their Order Management Systems (OMS) to adopt an "Omnibus Account" model to connect with licensed VATPs. The strategic significance of this measure is to leverage Hong Kong's existing vast distribution network, allowing users to buy and sell tokenized assets through their familiar banking or brokerage apps. This can activate the vast dormant funds within traditional stock accounts.

Deepening the Commercialization of Project Ensemble: The Hong Kong Monetary Authority's (HKMA) Project Ensemble should not stop at experimentation. We recommend introducing a tiered incentive mechanism to provide performance-linked funding or capital relief to commercial banks that successfully issue tokenized deposits and achieve cross-bank interoperability. This will incentivize traditional financial institutions to shift from "observation" to "action," accelerating the integration of wholesale Central Bank Digital Currency (wCBDC) and commercial bank tokenized deposits at the wholesale level.

II. Investing in the Future: Guiding "Localized" R&D with Subsidies

While the blockchain world champions open-source spirit, for Hong Kong to build its own technological moat, it must possess proprietary technologies tailored to local and Greater Bay Area (GBA) business scenarios. We recommend the budget establish a "Specialized Fund for Local Virtual Asset R&D." Unlike broad technology grants, this fund should precisely align with Hong Kong's strategic needs:

Focus on Application Scenarios: Prioritize subsidizing projects that address Hong Kong's financial pain points, such as those achieving on-chain "Payment-versus-Payment/Delivery-versus-Payment" (PvP/DvP), which is the final piece of the puzzle. For example, subsidize enterprises transitioning trade settlement processes from the traditional T+2 fiat model to a T+0 stablecoin mechanism. This not only aligns with the HKMA's policy roadmap but also directly reduces the transition risk for early adopters.

Guide Global Developers to "Look East": Through fiscal support, attract top global development teams to shift their R&D focus towards technical architectures that meet Hong Kong's regulatory standards and the GBA's interconnectivity needs. This is not merely a capital investment but also a strong signal to global developers—Hong Kong is the best testing ground for Web3 technology implementation.

III. Strengthening the Foundation: Shifting Education from "Speculation" to "Utility" and Adopting a "Practitioner-First" Pragmatic Strategy

The long-term prosperity of the market depends on user awareness. In the past, public perception of virtual assets often remained at the speculative level of price volatility. The 2026 budget should strive to reverse this trend, promoting education and outreach centered on "utility." In talent cultivation, this association advocates adopting a pragmatic "practitioner-first" strategy to address the current severe "talent gap." The market reality is that "crypto-natives" understand technology but often disregard rules, while "licensed financial professionals" understand rules but may be apprehensive about technology. Compared to four-year university degrees, transition programs targeting incumbent professionals are more effective in addressing the urgent needs when the new regulatory system fully takes effect in 2026.

Talent Pool Development: Recommend allocating funds to subsidize universities and vocational training institutions to incorporate blockchain technology, smart contract auditing, and crypto-financial regulations into their regular curricula. This will help build a world-class Web3 talent hub, addressing the industry's acute talent shortage.

Encourage Professional Training for Practitioners: Subsidize existing SFC licensees (e.g., Responsible Officers (ROs) and licensed representatives) to pursue advanced certification courses in virtual asset compliance, risk management, and smart contract auditing. This can rapidly transform talent from the traditional finance "old money" sector into experts capable of navigating the "new money" space.

Scenario-Based Promotion: The government should actively fund high-profile industry events like the "2026 Digital Asset Week," but the focus should shift from pure industry networking to "application showcases" targeted at SMEs and institutions. By setting up DeFi application demonstration zones, traditional enterprises can experience firsthand the convenience and efficiency of RWA financing, thereby driving the true integration of virtual assets into the real economy.

The 2026-27 fiscal year budget will be a watershed moment for Hong Kong's virtual asset development. Through precise liquidity incentives, strategically-minded R&D subsidies, and pragmatic education and promotion, we have the capability to upgrade Hong Kong from a market with the "clearest regulation" to a global virtual asset center with the "most abundant liquidity, leading technology, and widespread application." This is not only an investment in fintech but also a crucial strategic layout for Hong Kong's future economic growth engine.

Protecting the Assets of the Elderly, Building a New Era of a Robust Silver Economy

As one of the world's cities with the highest life expectancy, Hong Kong is rapidly advancing into a deeply aging society. Data from the Census and Statistics Department shows that in 2024, the proportion of the population aged 65 or above in Hong Kong has reached 23.9%, officially entering the "super-aged society" stage. Concurrently, the SAR Government has established the "Task Force on Promoting the Silver Economy" and introduced 30 measures aimed at unleashing the consumption potential and economic contributions of the elderly. It is projected that by 2034, the scale of "silver consumption" could approach HKD 500 billion. However, behind the grand vision of actively developing the "silver economy," a fundamental issue closely related to the well-being of the elderly, yet often overlooked, urgently requires societal attention: how to effectively protect the property security and proper management of the elderly, especially those with declining mental capacity? This is not only about wealth inheritance and dignity in later life for individual families but also directly impacts the healthy, sustainable development of the silver economy and overall social stability.

The situation in Japan serves as a warning for us. Bloomberg cited data indicating that elderly individuals in Japan showing signs of cognitive decline control approximately HKD 15.66 trillion in liquid assets. Statistics from the Japan Securities Dealers Association further reveal that shareholders aged 60 and above already constitute 42% of retail investors. Economists warn that as financial decision-making abilities are impaired by aging, this massive pool of "dementia funds" faces risks of mismanagement, erosion by fraud, or asset freezing. This could not only lead to large-scale loss of family wealth but also drag down investment and economic vitality. In contrast, a white paper released by a financial institution and a foundation focused on the elderly in Hong Kong points out that the top concerns among surveyed elderly individuals include financial risks such as "asset depreciation due to inflation" and "worries that savings are insufficient to cover medical expenses." This indicates that local elderly individuals similarly face pressures related to asset preservation and planning, and cognitive decline could make the situation more severe.

Protecting the property security of the elderly prioritizes "preparedness" and the widespread application of "legal tools." Hong Kong's existing Enduring Power of Attorney (EPA) Ordinance (Cap. 501) is one such crucial tool. It allows an individual, while mentally capable, to appoint a trusted person (the attorney) in advance to handle their property affairs if they later lose mental capacity. This effectively avoids the predicament where, once mental capacity is lost, family members would have to manage the individual's assets through complex, time-consuming, and limited guardianship or trusteeship procedures under the Mental Health Ordinance. The latter process is not only cumbersome but also initially restricts the guardian's authority in handling finances to a limit of HKD 15,000 per month, which is far insufficient for elderly individuals owning property or investment portfolios. Therefore, the financial industry, legal profession, and social welfare organizations should strengthen collaboration to vigorously promote the importance and steps of establishing an EPA to the public, especially the "post-50" demographic and their families, making property planning a core component of retirement preparation.

Secondly, financial institutions should actively innovate by introducing "family-collaborative" financial management services suitable for elderly clients. Japan's financial industry has pioneered "family support" accounts or trusts, allowing family members to co-manage assets while the elderly individual still has cognitive capacity, thereby establishing management habits and transparency early. Hong Kong's banks, securities firms, and insurance companies can learn from this model to design more flexible joint accounts, family trusts, or insurance plans. While protecting the autonomy of the elderly, they can introduce trusted family members as co-decision-makers or pre-authorized persons. This not only helps prevent fraud early (Japanese data shows over 65% of fraud victims are aged 65 or above) but also ensures seamless asset management as the elderly individual's decision-making ability naturally declines. This maintains appropriate activity in investment portfolios, preventing assets from becoming "inactive" and detached from productive use over time.

Furthermore, ongoing investor education must closely align with the characteristics of an aging population. The author believes that educational content should not solely focus on market analysis but must also cover "financial risk management in the silver years." This includes: identifying financial fraud, understanding age-adjusted asset allocation strategies, learning about estate planning tools (such as wills, enduring powers of attorney, and trusts), and encouraging intergenerational financial communication. A white paper by BOC Life found that only about one-third of elderly individuals have had in-depth financial discussions with their children. This silence is a primary cause of delayed planning. The industry can organize joint workshops targeting "the elderly and their caregivers" to break the taboo around discussing money, making planning a shared family topic and thereby reducing future uncertainty.

Protecting the property security of the elderly and developing the "silver economy" are, in fact, two sides of the same coin, complementary and mutually reinforcing. The development potential of the silver economy is immense. Hong Kong's silver consumption in 2024 is estimated to reach HKD 342 billion, accounting for 11% of local GDP. The government and businesses can further stimulate economic growth by promoting products and services targeted at the elderly. For the measures proposed by the government task force—such as encouraging the development of silver products, promoting elderly employment, and developing silver technology—to unleash their maximum effectiveness, they must be based on the confidence of the elderly in their own financial security. When the elderly do not need to excessively worry about their assets being misappropriated or mismanaged, they are more willing to consume, participate in society, and re-enter the job market, thereby creating a virtuous economic cycle. Conversely, if gaps exist in the property safety net, not only could personal savings suffer losses, but family disputes and social support pressures will also increase, ultimately consuming societal resources that could otherwise be used for the development of the silver industry.

In summary, while embracing the opportunities of the silver economy, Hong Kong must solidify the foundation of property security for the elderly. This requires the joint efforts of the government, financial regulators, industry professionals, social welfare organizations, and families, focusing on promoting legal planning tools, innovating financial products, and deepening financial literacy education, among other aspects. Only by enabling the elderly to manage their lifelong accumulated wealth with peace of mind and dignity can we truly activate the consumption power and creativity of this vast demographic. This will ensure that the "silver economy" is not merely a GDP growth point but also a solid driving force for building a caring, inclusive, and sustainable "age-friendly" society. Protecting the elderly today is an investment in our shared tomorrow.

Establishing a Civil Securities Class Action System

As an international financial center, Hong Kong's foundation in the rule of law and its investor protection mechanisms are crucial pillars for the stable operation of its markets. However, when facing large-scale infringements, the existing legal tools have shown inadequacies in safeguarding the rights of retail investors. Mainland China's active advancement of the Securities Special Representative Action System provides a powerful judicial remedy for small investors. Simultaneously, the SFC’s litigation on behalf of investors under Section 213 of the Securities and Futures Ordinance (SFO) also demonstrates the unique value of the regulator. Yet, when the SFC does not exercise its power, the public lacks a "class action system" to initiate legal action. Hong Kong should learn from the mainland experience, enhance the functions of the SFC, and construct a comprehensive protection system where administrative supervision, judicial remedies, and class actions complement each other.

Advantages and Limitations of the Existing Mechanism

The SFC, as an independent regulator, possesses a diverse range of enforcement tools. The most prominent is initiating civil litigation under SFO Section 213 to directly seek remedies for harmed investors. From the "Hontex International fraud case" to the "Tiger Asia Management insider trading case," the SFC has successfully compelled lawbreakers to return funds or pay compensation to thousands of investors, with amounts often reaching hundreds of millions or even billions of Hong Kong dollars. This model has clear advantages: the SFC, leveraging its professional team, investigative powers, and information advantages, can effectively challenge powerful wrongdoers; the litigation process is efficient, preventing retail investors from fighting isolated battles; and with the goal of "restitution," it often enables investors to receive compensation close to the full amount swiftly.

However, SFC-led litigation has its limitations. Its initiation depends on the SFC's investigation results and resource allocation, carrying an administrative discretion element rather than being a regular, accessible remedy right that investors can proactively seek. Furthermore, such litigation primarily targets egregious market misconduct with clear evidence. For common cases of misrepresentation by listed companies, the SFC may not pursue compensation litigation for each instance.

On the other hand, the existing judicial remedy avenues in Hong Kong present high barriers for retail investors. The "representative action" under the Rules of the High Court is rarely applicable in securities disputes due to its stringent "same interest" requirement. As noted by the Working Party on Civil Justice Reform under the Chief Justice of the Court of Final Appeal (Hong Kong Law Reform Commission's Report on Class Actions, May 28, 2012), the current mechanisms are "inadequate" for handling large-scale securities disputes. For retail investors seeking compensation on their own, the options are joint or separate actions, which involve multiple obstacles: difficulty in evidence gathering, high costs, cumbersome procedures, and significant disparity in resources compared to listed companies. This leads many aggrieved investors to abandon their claims, indirectly lowering the cost of wrongdoing and weakening market discipline. When facing resource-rich listed companies, retail investors are often deterred by potentially ruinous legal costs and fail to obtain the judicial remedies they deserve.

Insights from Mainland China's Securities Class Actions

Since the implementation of the new Securities Law in 2020, mainland China's "securities class action system with Chinese characteristics" has achieved groundbreaking progress. Its core is the Special Representative Action mechanism based on an "opt-out" principle. An investor protection institution, upon receiving authorization from 50 or more investors, initiates litigation on behalf of all eligible investors. Unless investors actively declare their withdrawal, they are automatically included in the lawsuit and share in the compensation outcome.

The concluded "Zeda YiSheng case" in 2023 is a successful example. The Shanghai Financial Court, through mediation, recovered full losses of approximately RMB 280 million for 7,195 investors on the STAR Market. This case demonstrated multiple advantages: significantly lowering the threshold and cost of rights protection, solving the dilemma of retail investors being "unwilling, reluctant, or unable to sue"; creating a strong deterrent through the "strength in numbers" compensation effect; and focusing on efficiency and substantive dispute resolution, utilizing mediation, electronic platforms, and automatic compensation distribution mechanisms to swiftly realize rights.

The experience of the mainland system design is worthy of reference for Hong Kong: First, establishing a public-interest investor protection institution as the litigation representative to overcome collective action problems, ensuring the lawsuit centers on investor interests, and avoiding lawyer-driven litigation abuse. Second, courts actively playing a dynamic role in organizing mediation, holding hearings, and employing pre-action preservation mechanisms to balance investor protection with market stability. Third, establishing comprehensive supporting mechanisms covering the entire process from rights registration and loss calculation to compensation distribution, ensuring the system's operability.

Strengthening and Introducing Class Action Mechanisms in Parallel

Hong Kong can creatively integrate and innovate based on its common law tradition and regulatory foundation to build a multi-layered, complementary investor protection network.

First, the function and practice of the SFC seeking compensation for investors under SFO Section 213 should be further consolidated and expanded. In the future, the SFC could more proactively and systematically apply civil compensation litigation to various types of securities fraud cases, not limited to particularly egregious ones. The Legislative Council could consider reviewing relevant provisions to clarify and expand the scope of remedies the SFC can seek, and provide more adequate resource support, making it a regular, powerful tool for upholding market fairness and recovering investors' losses.

However, relying solely on the SFC is insufficient. Second, Hong Kong should, in a gradual and meticulously designed manner, introduce a securities class action mechanism based on an "opt-out" principle as an important supplement to SFC litigation, providing investors with a regular, accessible judicial remedy channel they can proactively initiate. In its specific design, it can draw on the experience of the mainland and other common law jurisdictions, establishing a rigorous court certification process to screen cases suitable for collective treatment and prevent litigation abuse.

More importantly, efficient case management and dispute resolution support mechanisms must be established. The promotion of mediation in resolving securities collective disputes should be vigorously encouraged. As demonstrated in the mainland "Zeda YiSheng case," mediation can quickly and conclusively resolve conflicts, allowing investors to receive compensation sooner. Simultaneously, electronic platforms need to be developed for rights registration, information notification, loss calculation, and compensation distribution. Learning from the cooperation model between the Shanghai Financial Court and China Securities Depository and Clearing Corporation Limited (CSDC), compensation funds can be distributed securely, accurately, and automatically to investors' accounts.

The Rule of Law Foundation for Consolidating the Financial Center Status

Introducing a securities class action mechanism is by no means a negation of the effectiveness of Hong Kong's existing regulatory system, nor does it encourage litigation abuse. On the contrary, it builds upon the strong enforcement of the SFC, adding "double protection" for investor rights remediation. It represents a deepening of the rule of law spirit and an enhancement of the market system. This not only addresses the reasonable expectations of the vast number of retail investors but also creates a powerful ex-ante deterrent by raising the potential cost of wrongdoing, thereby promoting compliance management and information disclosure quality among listed companies and elevating the overall market integrity.

Facing the opportunity presented by the national "15th Five-Year Plan's" support for Hong Kong in building itself into an Asia-Pacific international legal and dispute resolution services center, a modern, inclusive, and comprehensive investor protection legal system will be the most solid rule of law cornerstone for Hong Kong's status as an international financial center. By strengthening the SFC's civil compensation functions and introducing a well-designed class action mechanism drawing on mainland experience, Hong Kong can demonstrate to the world that it possesses not only an efficient and free market but also a fair and complete legal system capable of fully safeguarding the rights of small investors. Protecting small investors means protecting the foundation of the market. As a mature common law jurisdiction, Hong Kong has the capability to absorb successful experiences from overseas and the mainland to design a set of fair, efficient, and locally appropriate securities class action rules. This is not only a crucial step in upholding market fairness and justice but also essential for consolidating Hong Kong's status as an international financial center and promoting the sustainable development of its markets. It is time to empower small investors with stronger legal weapons, allowing the sunlight of the rule of law to reach every corner of securities rights protection.

Conclusion

Based on the comprehensive analysis and recommendations above, Hong Kong's capital market stands at a critical juncture characterized by both opportunities and challenges. To maintain and enhance its international competitiveness, systematic optimization and innovation must be pursued across multiple dimensions.

Regarding the spot market, simplifying the board lot system, reducing transaction costs (such as stamp duty), and enhancing regulatory efficiency form the foundation for lowering the entry barrier for retail investors and revitalizing market liquidity. For the commodity futures market, it is crucial to expedite the implementation of top-level design, improve infrastructure like warehousing and delivery, and leverage tax incentives and talent policies to seize opportunities in the global commodity markets, thereby solidifying Hong Kong's position as a regional pricing hub.

The quality and credibility of the IPO market are vital for its long-term health. We must directly address the risks arising from excessive concentration of sponsor resources, declining document quality, and unintended consequences of systemic reforms (such as with FINI and the claw back mechanism). By formalizing workload management, reviewing current systems, and encouraging listed companies to contribute to the local economy, we can rebuild market confidence and achieve a transition from being "quantity-driven" to "quality-driven."

Addressing the core challenge of secondary market liquidity, reducing the stamp duty on stock transactions to a level comparable with the mainland A-share market, and considering the introduction of an exemption mechanism for low-liquidity stocks are direct and effective measures to stimulate the market. This will help create a virtuous cycle of improving liquidity.

The sustainable development of the asset management industry relies on a regulatory framework that keeps pace with the times, proactive support for technological transformation, and a more internationally competitive tax environment to retain and attract capital and talent.

In the rapidly evolving virtual asset space, Hong Kong has completed the initial phase of regulatory infrastructure. The next step should shift focus to "commercial application implementation." By improving liquidity in the RWA secondary market, accelerating product approvals, attracting international liquidity, and strengthening practitioner training, Hong Kong can upgrade from a market known for "clear regulation" to a global virtual asset center characterized by "abundant liquidity and widespread application." This aligns with the financial opening and digital economy strategies outlined in the national "15th Five-Year Plan."

Finally, perfecting the investor protection system is the cornerstone of a robust market. This includes proactively addressing the challenges of an aging society by promoting enduring powers of attorney, innovating financial products, and enhancing education to safeguard elderly assets, thereby supporting the healthy development of the "silver economy." Simultaneously, learning from mainland China's experience, we should explore establishing a securities class action system to complement the SFC's existing enforcement tools. This would provide retail investors with a more robust judicial remedy, enhancing the overall fairness and credibility of the market.

We are confident that through policy guidance and resource allocation in the Budget, promoting coordinated reforms in the aforementioned areas will effectively consolidate Hong Kong's status as an international financial center. This will stimulate market vitality, attract more high-quality enterprises and investors, and make greater contributions to Hong Kong's long-term economic prosperity and the nation's financial development strategy.

For any inquiries regarding this letter, please feel free to contact me (Tel: / Email: ) or our Director of Industrial Relations, Mr. Kenny How (Tel: / Email: ).

Your sincerely,

[Signature] [Chop]

Mofiz Chan

Chairman

Hong Kong Securities & Futures Professionals Association