Response Public Consultation on the 2025 Policy Address | Hong Kong Finance Market Reform: Policy Recommendations to Consolidate International Financial Center Status

Release Date: 2025-08-05

| Policy Address Team, Chief Executive's Policy Unit, | Email Submission: |

| 6/F, West Wing, Central Government Offices | policyaddress@cepu.gov.hk |

| 2 Tim Mei Avenue, Tamar, | |

| Hong Kong | |

To: Chief Executive Mr. John Lee

Response Public Consultation on the 2025 Policy Address

Hong Kong Finance Market Reform: Policy Recommendations to Consolidate International Financial Center Status

Hong Kong Finance Market Reform: Policy Recommendations to Consolidate International Financial Center Status

Dear Chief Executive Mr. John Lee,

Introduction

Hong Kong is facing unprecedented challenges in financial market competition. With the U.S. launching global trade wars that have triggered financial market volatility, and Singapore's aggressive competition in asset management and family office businesses, Hong Kong's position as an international financial center is under severe test. Chinese companies choosing the United States as their preferred listing destination, and investors favoring trading Chinese concept stocks like Alibaba and JD.com in U.S. markets, highlight the urgent need for structural reforms in Hong Kong's market.

Hong Kong has long served as a crucial role in China's external financial coordination, playing an irreplaceable function in serving the real economy, fundraising, and attracting investment. Facing intense international competition, Hong Kong must adopt more forward-looking policy thinking to drive comprehensive upgrades of its securities market. This policy proposal covers multiple key areas including stock trading unit reform, stamp duty adjustments, options market development, and digital financial innovation, aiming to build a more competitive and resilient financial ecosystem for Hong Kong.

Securities Market

Facing external economic challenges and instability, such as financial market volatility triggered by the US launching tariff wars globally, and competition from other markets like Singapore's asset management and family office businesses, Chinese companies are choosing the US as their primary listing market, and funds are choosing to trade Alibaba and JD.com stocks in the US.

Hong Kong has played an important role as China's external financial coordination hub for many years, serving the real economy by undertaking crucial functions in fundraising and attracting investment. To consolidate Hong Kong's position as an international financial center and prevent other markets from overtaking it, reforming Hong Kong stock trading units and gradually reducing or even eliminating stamp duty should be under consideration. Simplifying trading models and providing convenience for investors in terms of investment thresholds and risk control is very important, as is reducing transaction costs. Enhancing market liquidity, attracting capital inflows, strengthening the depth and resilience of Hong Kong's capital market, and enhancing the competitiveness of the financial industry - reforms to stock stamp duty and stock trading unit mechanisms are urgently needed.

The Necessity of Stock Trading Unit Mechanism Reform

Hong Kong's stock market has a 134-year history from 1891 to present, but there have been few records of discussions about reforming stock trading units. However, reforming the trading model to keep pace with the times by adopting "one share per lot" will bring enormous benefits to Hong Kong's stock market, both in terms of fundraising and secondary market trading. Furthermore, many mature foreign stock markets operate using "one share per lot" methods, such as the US (NYSE, NASDAQ), London (LSE), Euronext, Frankfurt Germany (Xetra), Singapore (SGX), Australia (ASX), and Toronto (TSX) all support "one share per lot" trading. As an international financial center, Hong Kong should have the capability to support similar types of trading and not lag behind others.

The trading model using lots as trading units has been used in Hong Kong for many years, with various unresolved problems persisting. For example, odd lots generated after stock consolidations, rights issues, or bonus share distributions are inconvenient to trade. If investors want to sell odd lots, they need to sell at a discount, and some stocks may not even have odd lot dealers to take them on. The problem of interested parties manipulating this to harm small investors' interests remains unresolved. These interested parties are mostly listed companies, their management, major shareholders, or a small group of related parties, who are also the resistance and opposing voices to stock trading unit mechanism reform. Additionally, if large numbers of retail investors purchase only one share, changing the shareholder structure and affecting corporate governance and decision-making processes is not what vested interests desire. They prioritize personal interests over social interests and hinder the Hong Kong government's efforts to maintain its international financial center status.

Any reform that can stimulate trading volume and fundraising amounts is crucial for Hong Kong's financial industry. Successfully matching buyers and sellers to facilitate stock and capital circulation is where market value lies. Our association supports this and has repeatedly and clearly reiterated our stance on defending industry interests.

"One share per lot" can bring multiple benefits to Hong Kong:

- Lower investment thresholds, increase market participation and citizens' sense of participation in economic results

- Increase market depth and promote market liquidity

- Increase portfolio allocation flexibility to achieve risk diversification

- Solve the odd lot problem

- Facilitate trading for returning Chinese concept stocks

- Establish a positive image of keeping pace with the times for Hong Kong's financial industry

Lowering investment thresholds allows citizens to decide their capital investment based on their financial situation, enabling citizens to experience the fruits of upward economic development through small amounts of capital. Investors can also achieve more effective risk diversification due to the portfolio allocation flexibility brought by "one share per lot." Expanding trading scale brings nothing but benefits to Hong Kong's stock market.

The discount and liquidity undertaking problems caused by odd lots will receive compromised solutions, reducing unfair situations for small investors.

To prepare for the return of Chinese concept stocks and facilitate investors who frequently trade related stocks, implementing "one share per lot" is a necessary policy. For institutional investors focused on trading Chinese concept stocks, executing trades only in board lots often limits them when they need to quickly adjust investment portfolios due to share quantities. After adopting the "one share per lot" mechanism, institutional investors can buy and sell precisely by shares, responding more flexibly to market fluctuations. Furthermore, there are currently about 286 Chinese concept stocks listed in the US with a market value of over a trillion dollars - we cannot ignore the potential economic benefits this brings.

Solving these problems can establish a positive image of keeping pace with the times for Hong Kong's financial industry while providing investors with higher quality and more flexible trading experiences, further consolidating Hong Kong's position as an international financial center.

Our association suggests that Hong Kong's stock market can implement "one share per lot" in phases across different boards, conducting substantive testing through various pilot programs to gather feedback for optimizing "one share per lot" related trading matters and necessary software and hardware support. (Please refer to Appendix 1)

The Necessity of Stock Trading Stamp Duty Reform

Currently Hong Kong stock trading stamp duty rate remains at 0.1%, which is high compared to other markets: A-shares (0.05%), Malaysia (0.1%), UK (0.5% buyer only). Some markets like the US, Japan, and Australia do not impose stock stamp duty.

Hong Kong's stock stamp duty is significantly higher than other markets, simultaneously raising transaction costs, suppressing market trading, and affecting long-term market development. Based on past experience, raising stamp duty has failed to bring expected additional tax revenue, instead substantially suppressing market trading. Trading activities are inhibited, and many investors consequently turn to other markets with lower costs. Taking Hong Kong's market as an example, after raising the stamp duty rate from 0.10% to 0.13% in 2021, the daily average turnover from August 2022 to July 2023 fell by over 31% compared to the same period the previous year.

From a macro perspective, examples from other markets regarding positive and negative impacts of lowering/raising stamp duty serve as evidence.

Examples:

In September 2008, A-share markets changed from bilateral stamp duty collection to seller-only collection, maintaining a 0.1% rate. The Shanghai Composite Index rose from 2067 points to 3478 points in less than a year, an increase of 68.2%. In 2023, stamp duty was further reduced from 0.1% to 0.05%.

After Malaysia's stock market raised stock stamp duty from 0.1% to 0.15% in 2022, trading volume decreased noticeably. After adjusting back to 0.1% in July 2023, the stock market immediately rebounded, showing that transaction costs have a direct impact on market activity.

From investors' and fund companies' perspectives, reducing/eliminating stamp duty is positive news for them. Well-known companies like Alibaba and JD.com are listed in both Hong Kong and the US with very active trading. Investors/fund companies can buy and sell the same companies in both locations, but their choice of different markets for trading comes down to transaction cost differences and the monetary and time costs of capital flows. Investors naturally tend to choose places with lower transaction costs and more abundant market depth. Since the US market has no stock trading stamp duty, investors/fund companies have a clear absolute advantage in transaction costs, while Hong Kong's market falls behind in comparison. Meanwhile, stock trading market depth is affected by market capital volume, so Hong Kong's market depth is inferior to the US market.

This shows that high transaction costs weaken Hong Kong's attractiveness to international capital. Reducing transaction costs to promote capital inflows is what we should be doing. If we don't keep pace with the times, we will ultimately lose our competitive advantage, and our international financial center status will be handed over to others.

For Hong Kong's long-term prosperous, stable, and healthy financial development, phased reduction/elimination of stamp duty policies should be under consideration. The following table serves as a reference for phased reduction/elimination of stamp duty policies.

| Phase | Time Range | Measures | Expected Effects | Risks & Countermeasures |

| Phase 1: Pilot Reduction | 6-12 months | Reduce stamp duty from 0.1% further | Lower transaction costs and stimulate trading | Short-term reduction in fiscal revenue; Increased speculative trading: Study T+0 restrictions |

| Phase 2: Further Reduction | 12-24 months | Further reduce stamp duty from Phase 1; Introduce "stamp duty offset" mechanism | More trading volume than Phase 1; Enhanced institutional long-term M&A willingness | Liquidity volatility: Strengthen market maker system to ensure market depth |

| Phase 3: Complete Elimination | 24-36 months | Completely eliminate stamp duty; Simultaneously revise trading levies to maintain regulatory and exchange operating funds | Costs among world's lowest; Enhanced market depth | Speculative volatility: Strengthen margin trading risk control mechanisms |

Hong Kong's securities industry warmly welcomes the "one share per lot" approach and hopes the government understands that the benefits of reducing or eliminating stamp duty far exceed the tax revenue itself. We sincerely hope the government will quickly implement related policies to protect the interests of most investors and the general industry. This move benefits Hong Kong's financial market development, builds a more solid foundation for Hong Kong's reputation as an international financial center, and allows the financial industry to continue thriving in more favorable soil, contributing to Hong Kong's economic development and the motherland's prosperity and stability.

Appendix 1

| Phase | Time Range | Board Scope | Main Work | Monitoring Indicators |

| Phase 1 | Q1-Q2 2026 | Growth Enterprise Market (GEM) | Trading matching and risk control system upgrades; Settlement mechanism and delivery testing; Education and promotion for brokers and investors | Average trading volume; Bid-ask spreads; System matching delays |

| Phase 2 | Q3-Q4 2026 | Main board stocks in bottom 30% by market cap | Trading fee and levy review; Centralized market feedback collection | Stock turnover rate; Market depth |

| Phase 3 | Q1-Q2 2027 | Hang Seng Index, Hang Seng China Enterprises Index and other large-cap constituent stocks | Large transaction execution simulation and stress testing; Comprehensive trading system and settlement platform stability verification | Block trading proportion; Price volatility range; Trading system load |

Stock Options

In the investment world, there's a common analogy: if an exchange is a casino and investors are gamblers, then the gaming tables are the various investment products available for trading on the exchange. If a particular type of game offers higher flexibility and attractiveness (i.e., better odds), it naturally attracts gamblers' favor and spawns multiple variations and types. Take baccarat, for example—from traditional gameplay, it has evolved into commission-free, big table, medium table, mini, squeeze card, dragon bonus, pair betting, and other diversified variations. Today in casinos, baccarat tables are often numerous enough to form a dedicated area, driving the overall business atmosphere of the entire casino.

In financial markets, stock options are like baccarat. Their functions in short-term and long-term hedging, speculation, arbitrage, and income generation have been recognized by the market. In the US market, according to Chicago Board Options Exchange (CBOE) data, as early as 2020, the daily average notional trading value of US stock options had reached over $450 billion, surpassing the stock market's $405 billion, demonstrating the importance of stock options and their attractiveness to investors. However, while Hong Kong's stock options market has developed steadily and has become the highest-volume derivative product in Hong Kong, its trading volume relative to the stock market remains significantly low, like ordinary gaming tables in a casino, failing to unleash its potential to drive the overall market.

Why is there such a vast difference in stock options activity between the US and Hong Kong?

- Low Coverage Rate

Exchanges do not provide options products for all stocks. However, the US market has a significantly higher stock options coverage rate: the two major US exchanges list approximately 5,000+ stocks, of which over 3,000 have stock options, achieving a coverage rate exceeding 60%. In contrast, Hong Kong has approximately 2,000+ stocks, but stock options only cover 132 of them, with weekly stock options covering merely 11 stocks, resulting in an overall coverage rate of less than 6%. This means the stock options coverage rate gap between US and Hong Kong markets is 10-fold.

Taking June 2025 data as an example, among the 100 most actively traded stocks in Hong Kong's stock market, only 63 provided stock options (63% coverage rate). In comparison, all top 100 active stocks in the US market have stock options available, achieving 100% coverage.

- Failure to Cover Suitable Underlying Assets

In Hong Kong's market, some long-term popular stocks with substantial businesses, unique operations, high trading volumes and volatility, such as POP MART (9992) and Horizon Robotics (9660), are focal points for global investors and have great potential for stock options launch, yet they have not been included. Looking at ETFs (Exchange Traded Funds), which are highly promoted by authorities with over 300 launched in Hong Kong's market, only 5 have stock options available. Even some ETFs with higher trading volumes, such as 3033 and 7552, do not offer stock options.

In contrast, the US market not only provides stock options for popular stocks but also offers options products for corresponding ETFs, forming flexible and multi-layered product combinations that achieve synergistic effects between products, mutually promoting trading volumes.

- Unattractive Option Premiums

Hong Kong stock options' underlying assets are mostly blue-chip stocks, which typically have relatively stable prices and lower volatility, resulting in insufficient option premium attractiveness. For example, using data from the day of writing:

• HKEX (388): Volatility rate approximately 2.88%, 1 lot market value approximately HK$44,000. If selling one put option expiring in 10 days (strike price at 90% of current price), the premium is only about HK$70.

• US stock U (Unity): Volatility rate approximately 2.54%, 100 shares market value approximately HK$26,000. If selling one put option under the same conditions, the premium can reach US$74 (approximately HK$581).

Despite Unity having lower volatility than HKEX and the option contract being cheaper, its premium is about 8 times higher than HKEX's, clearly showing Hong Kong stock options' insufficient attractiveness.

- Incomplete Contract Standardization

Due to the complexity and diversity of derivative instruments, exchanges typically establish unified contract standards to facilitate investor trading, and stock options are no exception. However, Hong Kong stock options have contract units set as both "more than one board lot of underlying shares" and "equal to one board lot of underlying shares." Conversely, in the US market, one stock option contract uniformly represents 100 underlying shares, making it easy to understand and trade. Additionally, among Hong Kong's 132 stock options, 6 series have minimum price movements of HK$0.001 (others are 0.01). Such non-standardization easily confuses investors and requires them to make additional adjustments.

Hong Kong's Stock Options Market Has Enormous Development Potential

Hong Kong's stock options market has a long history, surpassing Hang Seng Index futures since 2006 to become one of Hong Kong's most active derivative products. In recent years, HKEX has continuously launched new products, such as weekly stock options series launched in November 2024, 6 new stock options categories added in March 2025, and plans to launch end-of-day options in the first half of next year. However, the four major issues mentioned above still constrain further market development.

Since most trading in the stock options market relates to arbitrage and hedging activities, its development can add additional liquidity to the overall market, strengthen price discovery mechanisms, improve market efficiency and depth, thereby benefiting other market products. This will help boost overall trading volumes and consolidate Hong Kong's position as an international financial center, much like how casinos rely on baccarat areas to drive overall business.

Therefore, our association recommends establishing a precise and efficient fast-track inclusion mechanism to rapidly launch weekly and monthly stock options for suitable stocks, improving the breadth and depth of stock options products, optimizing market structure, enhancing international competitiveness, and preventing the US market from dominating this field alone.

The Necessity and Implementation Plan for Establishing a Shared Blacklist Database for Securities Firms

In today's rapidly developing financial markets, the security of securities trading has become a focal point of attention for all parties. With technological advancement, the situation of criminals using various means to conduct financial fraud and money laundering activities has become increasingly serious, posing significant threats to investor confidence and market stability. To effectively combat these illegal activities, establishing a shared blacklist database for securities firms appears particularly important. This article will explore the necessity of this database, its operational mechanisms, and its impact on the entire financial market, while further illustrating its importance through actual case studies.

Current Status of Illegal Activities

In the current financial market, although many securities firms monitor and handle suspicious transactions, due to the lack of effective information sharing mechanisms, criminals often quickly move to another securities firm to continue their illegal activities after being discovered by one firm. For example, after a criminal conducts fraudulent transactions at Securities Firm A and is discovered, the firm immediately cancels their account. However, the criminal quickly moves to Securities Firm B to open an account and continues their fraudulent activities, ultimately causing multiple investors to become victims and resulting in substantial losses.

The Necessity of a Shared Blacklist Database

The primary purpose of establishing a shared blacklist database for securities firms is to enhance the transparency and security of financial markets. This database will centrally record all information related to individuals identified as criminals, including but not limited to their trading behaviors, identity information, and types of fraud involved. By sharing this information, securities firms can effectively identify and refuse account opening applications from criminals, preventing fraudulent activities from occurring at the source.

For example, suppose a criminal is blacklisted due to trading behavior at Securities Firm A. When they attempt to open an account at Securities Firm C, that firm can immediately access this information and thus refuse their account opening application, avoiding potential fraud risks. Additionally, this database can enhance regulatory authorities' monitoring capabilities of the market. By analyzing data in the blacklist, regulatory authorities can promptly identify new types of fraudulent schemes emerging in the market and formulate corresponding countermeasures to address emerging financial crimes.

Operational Mechanisms of the Database

1. Database Establishment and Management

Following the model of the Hong Kong Banking Association's establishment of "CICS" (Credit Information Sharing Scheme), the securities industry can collaborate with exchanges/securities regulatory commissions to establish an independent institution specifically for collecting and evaluating illegal cases reported by securities firms, providing brokers with a platform to verify customer backgrounds. Alternatively, the securities regulatory commission should be responsible for establishing and managing this shared blacklist database. As the regulatory authority of financial markets, the securities regulatory commission possesses the necessary authority and resources to ensure effective operation of the database.

2. Reporting Mechanism

Securities firms must promptly report relevant information to the database upon discovering suspicious transactions. Reported information should include the identity information of suspicious individuals, transaction records, and related evidence. The securities regulatory commission will verify this information and decide whether to include the individual in the blacklist.

3. Blacklist Usage

When opening accounts for new customers, securities firms must query whether the customer is on the blacklist. If a new customer is found to be on the blacklist, their account opening application can be refused. Additionally, securities firms should regularly examine the trading behavior of existing customers and promptly update information in the blacklist.

4. Legal Safeguards

To ensure that the database's operation receives legal support, it is recommended that legislative bodies formulate corresponding laws and regulations, clarifying securities firms' reporting obligations and penalties for criminals, thereby increasing their deterrent effect.

Impact on Financial Markets

Establishing a shared blacklist database will have profound impacts on financial markets. First, this measure will enhance investor confidence and promote capital inflow. In a secure and transparent market environment, investors are more willing to invest, which will contribute to market activity and overall economic growth.

For example, a securities firm successfully avoided a major fraud incident by actively participating in the shared blacklist database, which led to stable growth in the firm's customer base and subsequently attracted more investors, enhancing its market competitiveness.

Second, through information sharing, cooperation among securities firms will be strengthened, forming an alliance against financial crimes. This not only helps enhance the industry's overall prevention capabilities but also promotes trust and cooperation among securities firms, creating a positive competitive market environment.

Finally, establishing a shared blacklist database will promote communication and cooperation between regulatory authorities and market participants. Regulatory authorities can adjust regulatory policies promptly based on data in the database, thereby more effectively responding to market changes and potential risks.

Conclusion

When facing increasingly serious financial fraud problems, the necessity of establishing a shared blacklist database for securities firms is self-evident. This measure can not only effectively combat illegal activities but also enhance market transparency and stability. Through joint efforts from all parties, we can create a safer trading environment for investors, thereby promoting healthy development of financial markets. In the future, it is necessary to continuously improve relevant laws, regulations, and technical support to ensure the effective operation of the database and safeguard the security of financial markets.

Optimization Considerations for the High Shareholding Concentration Alert Mechanism

Hong Kong regulatory authorities periodically issue "high concentration" alerts regarding the shareholding distribution of listed companies. This initiative has good intentions and fully aligns with the regulatory stance of protecting investors. However, the current system has numerous controversies, and through this article, our Association hopes that relevant institutions can optimize the current system.

What constitutes high shareholding concentration? High shareholding concentration refers to company shares being controlled by a small number of shareholders, resulting in extremely low "free float" circulating in the public market. When regulatory authorities issue named alerts, they often involve cases of extremely concentrated shareholding structures: for example, over 90% of a listed company's shares are actually held by ten to twenty-plus shareholders (including major shareholders and other large shareholders), with the true "free float" circulating in the public market potentially representing only an extremely low percentage.

Risks and Market Impact: High shareholding concentration means company shares are controlled by very few individuals, creating so-called "cornering of supply." Under this structure, relevant shareholders have the ability to significantly influence share prices through small trading volumes. When stock trading is sparse, share prices and valuations can easily become distorted, resulting in irrational large fluctuations and breeding market manipulation risks.

Even after listed companies subsequently resolve shareholding concentration issues, regulatory authorities still refuse to remove them from historically published shareholding concentration lists, with their official websites even retaining records dating back to 2009. However, the contradiction lies in the fact that for licensed persons, disciplinary action records are no longer publicly displayed after five years; cold shoulder orders are also removed from websites once they become invalid. Since there are time-limited disclosure principles even for violations, why is lifetime tracking adopted for shareholding concentration issues that are merely risk alerts (not violations)? This results in relevant companies facing obstacles when seeking bank financing over a decade later, simply because they were once named for "high shareholding concentration." It must be clearly stated: "high shareholding concentration" itself is not illegal or non-compliant behavior, while "disciplinary actions" and "cold shoulder orders" are regulatory measures targeting actual violations. If the former is disclosed indefinitely, it is tantamount to permanently exposing those who have not violated the law. What difference does this essence of lifetime "stigmatization" have from the due process of punishing violators?

Data as of July 20, 2025, shows that since July 8, 2009, a total of 217 high shareholding concentration announcements have been issued. Among these, 3 companies have been delisted but have relisted using the same stock codes. For these "delisted but reusing the same stock codes" companies, not being removed from the announcements is unfair, as this may affect their business reputation and consequently lead to obstacles in financing or business expansion. Additionally, 35 companies have been delisted, but their announcements still exist. These two categories of companies combined account for 17.5% of total announcements.

Procedural Optimization Recommendations

Under the current mechanism, public disclosure of regulatory alerts is often accompanied by severe stock price volatility, a result worth contemplating:

The "suddenness" problem of alerts: The current approach is like "actively detonating," lacking an early warning period. Regulatory authorities possess key information, while the market (including minority shareholders) is completely in the dark before alert issuance. This information gap objectively places minority shareholders and major shareholders in the same passive position, with the former even bearing greater impact due to lack of buffer time.

Our Association acknowledges regulatory authorities' determination to maintain market quality, and the risks of high shareholding concentration cannot be ignored. However, the side effects of the current "surprise attack" alert issuance procedure may deviate from the original intention of protecting investors (especially retail investors). When share prices plummet instantly due to regulatory actions, retail investors often bear the brunt and find it difficult to respond effectively.

Our Association earnestly recommends that regulatory authorities review current procedures, which would:

- Provide opportunities for responsible parties to make corrections: With fairness as the premise, give major shareholders/companies time to take substantial action to improve shareholding structures. Meanwhile, regulatory authorities must strictly monitor the trading behavior of major shareholders and listed companies, prevent insider trading or improper reduction of holdings, and ensure that the interests of small and medium investors are not harmed.

- Reduce disorderly market volatility: Avoid directly triggering market panic selling due to regulatory actions.

- More fairly protect minority shareholder interests: Reduce their risk of instantly suffering major paper losses due to sudden regulatory information.

Effective regulation should achieve balance between risk alerts and market stability. Optimizing shareholding concentration alert procedures to make them more predictive and constructive can both maintain the authority of Listing Rules and better reflect genuine protection for all market participants (including retail investors). Our Association urges relevant institutions to actively consider this optimization direction and jointly enhance the resilience and fairness of Hong Kong's market.

Compliance and Labour Aspects

Despite Hong Kong's continued economic recovery, the employment market shows signs of deterioration, with insufficient consumer confidence, making it urgent to further strengthen local employment and economic development measures. Therefore, it is recommended that the Securities and Futures Commission (SFC) further optimize the localization regulatory requirements for key positions in licensed corporations. Currently, some licensed corporations, particularly those with shareholders located outside Hong Kong, exploit existing regulations by arranging only one Responsible Officer (RO) to reside in Hong Kong daily to meet regulatory requirements, while having other RO and Manager-In-Charge (MIC) positions concurrently held by employees of shareholder companies. These employees have neither established formal employment relationships with Hong Kong licensed corporations, nor applied for work visas, nor do they reside permanently in Hong Kong. This practice not only weakens local employment opportunities in Hong Kong and is detrimental to economic development, but more importantly, these key positions are crucial for supervising licensed business activities, and prolonged absence from Hong Kong may create compliance risks in company operations.

It is recommended that the SFC add requirements for work visas and permanent residence in Hong Kong when approving key positions such as RO and MIC, and regularly monitor the number of days these personnel spend in Hong Kong through Business Risk Management Questionnaire (BRMQ) format, to ensure that licensed business activities are effectively supervised and enhance the compliance and stability of Hong Kong's financial markets.

Development of Hong Kong Commodity Futures

First, reviewing the 2024 Policy Address, the Chief Executive proposed developing Hong Kong as a commodity futures center. However, in the following year, the author has not seen the implementation of related policies, which is disappointing. Although Hong Kong's IPO fundraising market has shown encouraging performance over the past year, to further enrich and consolidate Hong Kong's position as a financial center, actively developing commodity markets and commodity futures derivatives is necessary and should become our development goal.

With the legislation of stablecoins, the development of commodity futures can be implemented through the following multi-dimensional strategies:

- Strengthening Market Infrastructure

Although Hong Kong Exchanges and Clearing Limited (HKEX) has actively promoted London Metal Mini futures contracts, trading performance has been poor. Therefore, HKEX should consider upgrading futures trading and clearing system platforms to support more commodity derivatives (such as rare earths, lithium, carbon emission rights). Meanwhile, interconnect with international clearing systems (such as ICE Clear, LCH), introduce round-the-clock trading mechanisms, connecting London and New York sessions to attract cross-timezone investors. Additionally, leveraging the advantages of the Greater Bay Area, cooperate with local warehousing and logistics to ensure physical delivery capabilities for metals, energy, and other commodities, constructing a complete trading and settlement chain.

- Policy and Regulatory Innovation

Hong Kong should actively enhance its international market positioning through dual license mutual recognition, cross-listing contracts with Shanghai Futures Exchange (SHFE) and London Metal Exchange (LME). Meanwhile, simplify access procedures for mainland and international investors to attract global capital. Introduce compliant "sandbox" pilots, allowing new contract types (such as cryptocurrency commodity futures) to be temporarily exempt from certain restrictions, simplify compliance processes, and reduce or exempt stamp duty on commodity futures trading, provide tax credits for market makers, creating a friendly market environment.

- Expanding Product Diversification and Enhancing International Connectivity

Hong Kong can strive for Asian pricing power in commodities by launching RMB-denominated "Greater Bay Area benchmark contracts" for aluminum, copper, etc., benchmarking against LME. Additionally, integrate green finance by developing carbon emission futures, linking with Guangzhou Carbon Emission Rights Exchange. In this process, digitize the most popular gold and crude oil futures and connect with the Hong Kong Monetary Authority's e-HKD settlement. These measures will effectively attract global participants and specifically recruit international commodity trading giants (such as Glencore, Trafigura) to establish Asia-Pacific trading centers in Hong Kong, strengthen cooperation with Chinese banks, and provide "Belt and Road" commodity financing.

- Talent and Ecosystem Development and Regional Coordination

Cooperate with foreign commodity exchanges to train traders and establish "Commodity Futures Master's Programs," organize professional training programs, establish think tanks and index development, support the compilation of "Hong Kong Commodity Index" to enhance pricing influence. Additionally, establish Greater Bay Area warehousing networks, build bonded warehouses in Guangzhou Nansha and Qianhai to support futures delivery, and strive for priority allocation of QFII quotas. Strengthen ASEAN cooperation, such as cross-listing rubber contracts with Singapore, to diversify dependencies and reduce geopolitical risks.

This plan combines Hong Kong's financial infrastructure advantages with national strategy, aiming to capture a 25% share of Asia's commodity derivatives trading volume within five years, filling the gap in the internationalization of mainland futures markets.

Capital Market Reform

Small and medium enterprises (SMEs) serve as the lifeblood of Hong Kong's economy, accounting for over 90% of enterprises and providing approximately half of employment opportunities, playing a crucial role in Hong Kong's economic development. However, Hong Kong's capital market currently has shortcomings in serving SMEs, particularly the Growth Enterprise Market (GEM) has failed to fully utilize its role in providing financing support for SMEs. As global capital market competition intensifies, Hong Kong urgently needs to reform its capital market. On the occasion of public consultation for the 2025-26 Policy Address, we hereby propose the following recommendations for Hong Kong's capital market reform, hoping that the Hong Kong Special Administrative Region Government can make long-term plans to consolidate Hong Kong's position as an international financial center.

I. Analysis of Existing Problems in the GEM Board

Although HKEX made several reforms to the GEM Listing Rules in 2024, such as simplifying the transfer mechanism, adding "market capitalization/revenue/R&D tests" for high-growth R&D enterprises, and canceling mandatory quarterly reporting requirements, many problems still exist. Under the current market structure and related listing regulations, most SMEs in high-growth and development stages cannot list on the Hong Kong Stock Exchange market for various reasons. Although the GEM Listing Rules have no profitability requirements, their requirements for operating cash flow, market capitalization, R&D expense amounts, and lengthy IPO approval processes have resulted in GEM's overall lack of vitality and low attractiveness to investors and issuers, shutting out smaller but growth-potential SMEs. For example, current rules require operating cash flow of no less than HK$30 million over two years of performance periods, making it difficult for some small and medium-sized innovative technology companies with high valuations, low revenues but great future profit growth potential to enter the market. Considering market liquidity and fundraising in recent years, GEM's characteristics and attractiveness deserve re-examination.

II. GEM Board Reform Recommendations

(I) Reference NASDAQ's Tiered System to Establish Differentiated Listing Standards

HKEX can learn from the US NASDAQ market's tiered system, establishing differentiated listing standards for enterprises of different scales and development stages. For technology innovation enterprises, relax cash flow or revenue requirements, and in addition to existing financial qualification tests, add more dimensional assessment indicators such as user growth numbers and market share. For emerging industries and companies with great potential but unclear short-term profitability, provide more listing opportunities. For example, for internet platform companies, if their user activity and user scale indicators reach certain standards, listing should be permitted.

(II) Establish a "Green Technology Growth Board" to Promote Integration of Green Finance and Technology Innovation

We recommend establishing a "Green Technology Growth Board" focused on green technology-related startups and SMEs, allowing companies that are not yet profitable but have high growth potential to list first, and leverage Hong Kong's internationalized financing platform to attract global ESG (Environmental, Social, Governance) related investment funds. This will not only help promote Hong Kong's green finance development but also assist SMEs in innovation and growth in the green technology field, enhancing Hong Kong's influence in global green finance and technology innovation.

III. Conclusion

Hong Kong's capital market reform should center on "fairness" and "diversification," changing the current situation of excessive bias toward large enterprises. Through the above reforms to the GEM board, this will not only help Hong Kong consolidate its position as an international financial center but also enable it to play a greater role in national development strategies.

Financial Policy on Establishing a Stock OTC Market

In early 2025, according to market sources, HKEX and the Securities and Futures Commission of Hong Kong conducted preliminary discussions and were planning to formulate a blueprint for an over-the-counter stock trading market, providing exit opportunities for shareholders and investors after main board listed companies delist, but the model would differ from the US Pink Sheets market.

With the 2025 Policy Address approaching, our association suggests that the financial policy section of the Policy Address should focus on promoting the establishment of a stock OTC market. We hereby explain what a stock over-the-counter market (stock OTC market) is and provide some recommendations for reference by all parties.

As the name suggests, a stock OTC market is a market for trading unlisted stocks or stocks not traded on mainstream exchanges, with operating methods significantly different from exchange markets. The following are the specific operational processes, participation methods, and considerations for stock OTC markets:

- Choosing Trading Platforms or Brokers

- OTC stocks are traded through market makers (such as brokerage firms, investment banks) or electronic platforms (such as OTC Markets Group in the US), rather than mainstream exchanges like the New York Stock Exchange or NASDAQ.

- Investors need to open accounts through brokers that support OTC trading (such as Interactive Brokers, Fidelity, etc.)

- Order Trading

- Market maker quote-driven: Market makers provide bid/ask quotes, investors trade at quoted prices, with potentially larger spreads.

- Limit orders/Market orders: Similar to exchanges, but stocks with poor liquidity may be difficult to execute promptly.

Next, our association reviews the Hong Kong stock market situation. According to Sullivan Jetta Cloud Technology Research, as of the end of 2024, the total number of Hong Kong listed companies was 2,643, of which 1,298 companies had market capitalizations below HK$500 million, accounting for 49% of total listed companies; 531 companies had market capitalizations below HK$100 million, accounting for 20% of total listed companies; and 260 companies had market capitalizations below HK$50 million, accounting for nearly 10% of total listed companies.

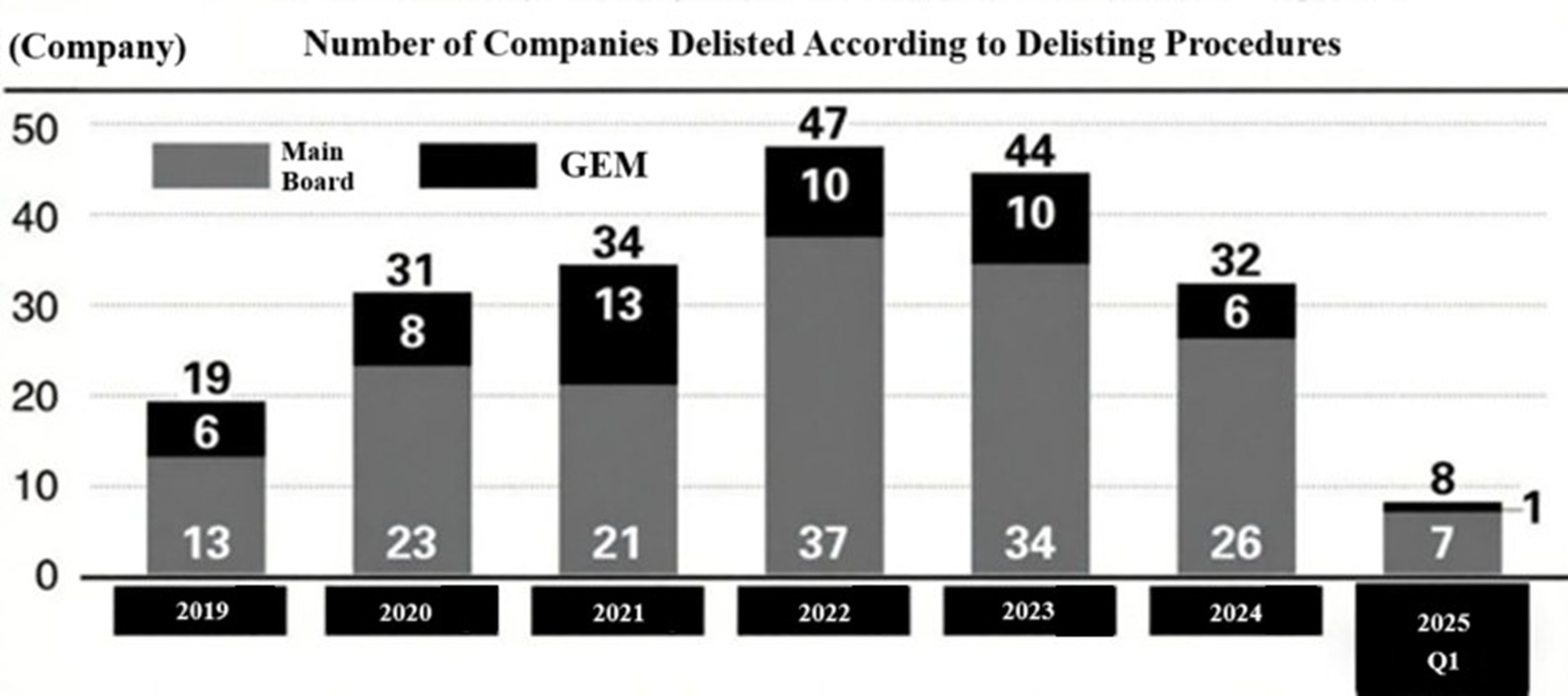

From 2019 to the first quarter of 2025, the total number of companies delisted from the Main Board and GEM according to delisting procedures was 215. Since HKEX introduced the "fast-track delisting" mechanism in 2018, over 100 listed companies have been forced to delist, with many affected shareholders' holdings becoming "waste paper."

Therefore, HKEX and the Securities and Futures Commission are studying the establishment of a stock OTC market for trading shares of companies delisted from the Main Board and GEM. According to market sources, HKEX's preliminary planning for the over-the-counter trading market will allow retail participation and involve market makers in matching trades to address liquidity shortages. However, the over-the-counter trading market will not allow new stock listings, will not allow trading of stocks delisted from other major exchanges outside HKEX, and will not provide a pathway back to the Main Board.

Additionally, the over-the-counter market may operate under a "buyer beware" model and restrict any stock recommendation activities. If brokers proactively suggest investments to investors, they will need to bear responsibility.

The Association's Recommendations:

- Support Introduction of Market Maker System — Enable thinly traded stocks to maintain quotes and liquidity, thereby improving pricing efficiency, which is very important for thinly traded companies. Since the introduction of the market maker system on August 25, 2014, China's NEEQ (New Third Board) has seen significant liquidity improvements and enhanced market pricing efficiency, which can serve as a reference.

- Support Main Board Return Mechanism — If delisted companies improve their operations and performance to meet listing standard requirements again, we recommend incorporating appropriate mechanisms to allow companies to transfer back to the Main Board or GEM, encouraging companies to operate diligently and establishing clear "turnaround" opportunities.

- Support Allowing Stock Issuance to Raise New Funds for Business Development — Usually, delisted companies have poor financial conditions. If they are prevented from issuing stocks in the market to raise new funds for business development, leading to lack of operating capital, this may cause the company's operating situation to deteriorate further, with company value and stock prices declining, making investors even more unwilling to participate in trading.

As our Chairman Mr. Mofiz Chan once stated directly, "If fundraising is not allowed and there is no pathway back to the Main Board or GEM, lacking upward mobility, delisted companies may become less motivated to operate, with investment value further undermined. This may make the over-the-counter market perform worse and worse, ultimately leading to fewer investors and turning Hong Kong's stock OTC market into a 'zombie market' with no trading. Following the example of numerous restrictions on Hong Kong SPACs compared to US SPACs, this would result in lack of investor support after the new system's market launch." This would waste another market reform opportunity and ultimately backfire.

Corporate Bankruptcy Protection Mechanisms

As an international financial center, Hong Kong appears backward in terms of corporate bankruptcy protection mechanisms. Since the first proposal of the Companies (Corporate Rescue) Bill in 2000, the legislative process has been initiated four times (2000, 2001, 2009, 2020), but has been repeatedly shelved due to controversies over issues such as employee rights protection. Twenty-five years have passed, and compared to competitors like Singapore and the United Kingdom, which have established sound bankruptcy reorganization systems, Hong Kong enterprises facing financial difficulties still have only "liquidation" as their sole option. Particularly at this moment of economic slowdown and a wave of liquidations this year, this systemic deficiency appears even more fatal.

Core Issues in the Legislative Deadlock

The controversial focus of successive bills has always been how to balance "employee rights protection" with "enterprise rescue feasibility." Regarding employee wage arrears protection mechanisms, early drafts required enterprises to reserve full wage arrears, leading to business concerns that this would drag down financially distressed companies. The 2020 compromise proposal adopted a "phased payment" approach, referencing the Protection of Wages on Insolvency Fund with set limits (such as a first-phase wage arrears limit of HK$36,000), and established a 45-day interim supervision period. Regarding creditor rights conflicts, major secured creditors enjoy "objection rights," meaning procedures can be initiated if no objection is raised within five days, while unsecured creditors worry that reorganization plans will damage their repayment priority. Despite multiple government adjustments to proposals, labor and management have remained unable to reach consensus, and legislation has been shelved each time the economy recovers.

Actual Costs of Legislative Delays

Legislative delays have brought multifaceted losses. First, economic efficiency losses are significant, with the World Bank's Doing Business Report repeatedly mentioning Hong Kong's lack of statutory rescue mechanisms. In 2024, Hong Kong's compulsory winding-up petitions reached 740 cases, up 30.7% from the previous year; in the first five months of 2025, Hong Kong's compulsory winding-up petitions numbered 315 cases, with reports estimating that 2025's full-year compulsory liquidation figures will be the highest since 2009. Second, under the current system, once enterprises face financial difficulties, they skip rescue and proceed directly to liquidation, making it even harder for employees to recover their rights. Additionally, when regional competitors like Singapore provide nine months of reorganization protection, Hong Kong lacks statutory breathing space, weakening enterprises' willingness to establish headquarters in Hong Kong.

Practical Solutions to Break the Deadlock

Legislative disputes have continued for twenty years, and empirical evidence shows that compromise solutions are feasible. Regarding employee protection, accepting the "phased payment" framework is viable, but the deadline for first-phase wage arrears payment should be shortened to 30 days, with personal legal liability clauses for interim supervisors regarding subsequent employment contracts. Enterprise flexibility also needs protection, allowing interim supervisors to adjust operational strategies, such as disposing of non-core assets, and clarifying the scope of "super priority claims" to protect new financing during reorganization. Additionally, strengthened supervision is necessary, empowering courts to quickly intervene in cases of procedural abuse, and requiring interim supervisors to disclose financial progress to creditors every 14 days.

No More Wasting the Next Twenty-Five Years

The government and Legislative Council must recognize that there are no perfect bills, only urgent needs. When waves of business closures sweep through catering, retail, and logistics industries, with employees joining the unemployment ranks daily, can we still sit and wait for "economic improvement before discussion"? We demand that the bill be placed on the Legislative Council's agenda and completed through three readings within this Legislative Council term. Additionally, a pilot mechanism should be established, with sunset clauses set for the first three years, allowing mechanism corrections based on actual operations. Hong Kong has already paid a heavy price for legislative delays; what is needed now is more courage for action, not more research.

Enterprise rescue mechanisms are not a compromise to capital, but salvation for the economic ecosystem. Saving one enterprise means saving the livelihoods of thousands of families.

Deep Integration of the Asset Management Industry and Government Policy

In recent years, the Hong Kong government has been committed to developing a more diversified financial market and has gradually strengthened support for innovative and high-tech enterprises. However, there remains a certain gap between current policies and market demands. To further promote deep integration between policy and the fund industry and create a mutually beneficial development environment, Hong Kong needs to adopt more targeted measures to build a world-class innovative financial ecosystem.

Current Challenges

Currently, government policies mainly focus on how to attract innovative enterprises to establish companies in Hong Kong, but subsequent support for these enterprises appears somewhat insufficient. Although government subsidy programs can help these enterprises solve initial funding and administrative issues, many startups still face resource and professional service needs for continued development, especially support from angel funds or venture capital funds. Meanwhile, the fund industry also faces the problem of insufficient quality projects, with many funds having adequate capital but struggling to find enterprises with high growth potential for investment. This supply-demand mismatch seriously constrains the development of Hong Kong's innovation ecosystem.

Recommendations for Policy and Fund Collaborative Development

To address the above structural challenges, the government should play a more active role as a key intermediary bridge, establishing systematic matching mechanisms to promote cooperation between innovative enterprises and local funds. Specific measures include the following:

- Promoting Exchange and Cooperation: Through specialized forums, investor matching sessions and other formats, create more exchange opportunities for innovative enterprises and funds. Fund managers can leverage their professional experience and analytical capabilities to screen enterprises with potential or provide advice to enterprises whose qualifications need further development, assisting their growth.

- Providing Incentive Measures: To encourage funds to invest in government-recommended projects, consider providing tax incentives or investment subsidies. For example, for funds investing in government-recognized innovative projects, provide a certain percentage of tax rebates or subsidies to reduce investment risks and enhance their willingness to participate.

Strengthening the Bridge Function of Cyberport and Science Park

As Hong Kong's main innovation incubation bases, Cyberport and Science Park should more actively organize various investment promotion activities, organizing matching sessions of different scales and themes based on enterprises' development stages and funds' investment preferences. Through regular roadshow activities, showcase high-potential enterprises within the parks to the fund community. Additionally, these incubators can establish project databases, detailing enterprises' technological advantages, market prospects, and funding requirements, helping enterprises precisely match with relevant industry fund managers to improve matching efficiency.

Encouraging Companies to List in Hong Kong

The government should actively support qualified growth enterprises of various types to list in Hong Kong, expanding the industry sectors and categories of listed companies in Hong Kong's stock market, further enhancing Hong Kong's attractiveness as an international financial center. This also provides venture capital funds and private equity funds with more exit or reinvestment channels, enhancing market liquidity.

Vision for Building a World-Class Innovation Ecosystem

Through deep integration of government policy and the fund industry, Hong Kong has the potential to build a healthy competitive innovation ecosystem: the government provides policy support and initial funding to help innovative enterprises through the startup phase; funds inject market-oriented capital and business experience to drive rapid enterprise growth; successful enterprises can attract more capital and talent through listing for investment, thereby strengthening the innovation ecosystem.

This "government-guided, market-operated" model is believed to more effectively address the dual dilemma of financing difficulties for innovative enterprises and project-finding difficulties for funds, enhancing Hong Kong's overall innovation capability and international competitiveness, ultimately achieving the strategic goal of building Hong Kong into a world-class innovation center.

Tax Exemption in Fund Management

We recommend raising the threshold for incidental transactions limited to 5% in DIPN61's unified fund tax exemption ordinance to accommodate current high-interest rate environment conditions. We also suggest the Inland Revenue Department consider treating interest income from holding debt securities as qualifying transactions to enhance the unified fund tax exemption ordinance's attractiveness, thereby promoting more fixed income, credit, and debt funds to establish in Hong Kong, strengthening Hong Kong's position as an international asset management center.

In June 2020, Hong Kong's Inland Revenue Department issued "Departmental Interpretation and Practice Notes No. 61" (DIPN 61), providing further interpretation of the "Taxation (Exemption from Profits Tax on Funds) (Amendment) Ordinance 2019" (Unified Exemption Ordinance). The Unified Exemption Ordinance took effect on April 1, 2019, extending Hong Kong tax exemptions to all funds, allowing all funds meeting certain conditions to enjoy Hong Kong profits tax exemption regardless of whether the fund is centrally managed and controlled in Hong Kong.

Funds must meet the following three conditions to obtain Hong Kong profits tax exemption under the Unified Exemption Ordinance. First, the entity must meet the definition of "fund" to obtain exemption. Second, profits generated must come from qualifying transactions or incidental transactions limited to 5%. Third, qualifying transactions must be carried out or arranged in Hong Kong by "specified persons." "Specified persons" include companies licensed by the Securities and Futures Commission. Otherwise, the fund must meet the definition of "qualifying investment fund."

Industry professionals point out that the government does not fully understand fund operations, weakening the effectiveness of concession measures, particularly condition restrictions in incidental transactions. The Inland Revenue Department considers holding debt securities to generate interest income not a securities-related qualifying transaction because it does not involve buyers and sellers, but holding securities to collect interest is an incidental transaction, thus subject to the 5% threshold limitation. We recommend the Hong Kong government reconsider and raise the threshold for incidental transactions limited to 5% to accommodate current high-interest rate environment conditions. We also suggest the Inland Revenue Department consider treating interest income from holding debt securities as qualifying transactions to enhance the unified fund tax exemption ordinance's attractiveness, thereby promoting more fixed income, credit, and debt funds to establish in Hong Kong, strengthening Hong Kong's position as an international asset management center, and enhancing Hong Kong's attractiveness when private funds choose registration and operational jurisdictions.

Family Offices

The rapid development of family offices within the Asian region is an undisputed fact, with most wealthy Asian families establishing family offices choosing between Hong Kong and Singapore as their locations. In the competition between Singapore and Hong Kong, many compare regional advantages, supporting infrastructure, and tax rates. Hong Kong possesses excellent talent, judicial systems, financial systems, and tax advantages, plus the government has introduced a series of measures in recent years to attract more families to establish family offices in Hong Kong. With these advantages and support, Hong Kong is no worse than Singapore, and may even be better.

In early 2024, Deloitte, one of the Big Four accounting firms, was commissioned by InvestHK to study Hong Kong's family office development. The report mentioned that the number of single family offices in Hong Kong reached 2,703 by the end of 2023, almost double Singapore's number. To date, there are still many criticisms about Hong Kong's family offices prioritizing quantity over quality. A year later, looking at the latest data from both jurisdictions, the Monetary Authority of Singapore (MAS) approved tax incentive qualifications for family offices, which surged by 600 from 1,400 at the end of 2023 to over 2,000, with 350 new additions in just the last four months of 2024, showing impressive momentum. Singapore's official data shows that the total number of family offices has exceeded 2,000; in contrast, Hong Kong's actual figures are difficult to grasp since family office operations do not require specific licenses, relying only on industry estimates. If InvestHK again commissions experts to conduct an in-depth study of Hong Kong's latest annual family office development using the same methodology, it would not be surprising if the rough estimate of single family offices exceeds 4,000.

Singapore has attracted family offices for years through clear regulatory thresholds and tax incentives. Under the 13U scheme, for example, family offices must possess at least S$50 million (approximately HK$300 million) in assets and employ at least three local staff members. In contrast, Hong Kong has not set clear investment thresholds to date, only requiring the establishment of local entities, qualified investments, and certain substantial economic activities, with no rigid requirements for staffing or asset amounts.

Undeniably, the SAR government's current strategy in promoting family office establishment leans toward quantity. This strategy has both benefits and drawbacks. The benefit is that it allows families intending to establish family office operations in Hong Kong to quickly set up family office holding structures and establish themselves in Hong Kong. However, the drawback is that many dubious so-called "family offices" have flooded the market, causing public misunderstanding about family offices. These "pseudo family offices" are not established and funded by any family to manage their family assets; rather, their common feature is borrowing the family office name to conduct product sales or provide consulting services to their clients.

The original intention of promoting family office development was to make Hong Kong a global wealth management center, while driving increased liquidity in local investment markets and revitalizing the employment market. If the research report by InvestHK and Deloitte is reliable, why haven't we seen significant increases in liquidity in various aspects of local investment markets and recruitment of local financial professionals? This year, everyone has clearly seen through news reports that many large banks and brokerages have conducted significant layoffs - this is an undisputed fact. Has the government's strategy achieved its purpose simply by promoting family office establishment, regardless of whether these established family offices actually invest locally? The government has always focused heavily on the quantity of local family offices. From another perspective, the Legislative Council passed the "Taxation (Amendment) (Tax Concessions for Carried Interest) Bill 2022" on May 10, 2023, with tax concessions applicable to any assessment year beginning on or after April 1, 2022. The Ordinance exempts family-controlled investment holding vehicles from profits tax on assessable profits derived from qualifying transactions and incidental transactions. To achieve the policy objective of bringing investment management and related activities to Hong Kong, family-controlled investment holding vehicles must be managed by qualified single family offices and meet the minimum asset threshold of HK$240 million and substantial activity requirements. Now that we're halfway through 2025, there have been at least two assessment years for single family office tax concessions. According to InvestHK's research report of 2,703 single family offices, how many have applied for this tax incentive? Does the government have actual figures that can be disclosed? If the figures are not ideal, does this reflect that the tax concession policy is inadequate? Or has the government not implemented relevant measures to encourage these single family offices to invest in local markets?

If there is no substantial help to local employment and investment market liquidity, we might consider changing strategy to pursue quality family offices establishing in Hong Kong. Singapore and Hong Kong's strategies are opposite, and both jurisdictions can progress simultaneously, with strategies that complement and reference each other. Singapore pursues quality family establishment, requiring MAS approval when applying to establish in Singapore, with applicants needing to meet 13O and 13U tax exemption approval criteria. These two tax exemptions have specific requirements for applicants' assets under management - 13O requires S$20 million, while 13U requires S$50 million. Additionally, applicants have scale requirements for local investment, with both requiring at least 10% of assets under management or S$10 million (whichever is lower) to be invested locally. High thresholds ensure quality for the Singapore government's family office pursuit. For applicants, although thresholds are high, 13O and 13U are not restricted by Singapore's Ministry of Manpower and can provide investors with opportunities to obtain "Singapore Employment Pass (EP)," allowing free entry and exit from Singapore without additional visa applications, and later enabling applications for "Singapore Permanent Residency (PR)" and "Singapore Citizenship." Singapore's strategy clearly pursues quality family offices while enhancing program attractiveness through personal identity planning and immigration policy coordination.

Our association has previously reflected on Hong Kong's actual family office situation, hoping the government remembers the original intention of promoting family office development. Taking this opportunity of the Policy Address public consultation, we again recommend that the government should: (1) establish approval criteria to prevent abuse of the family office name, ensuring quality family offices establish in Hong Kong; (2) enhance Hong Kong's attractiveness for family office establishment through immigration policy coordination; (3) establish substantial measures to promote these established family offices to invest locally, systematically improving local financial market liquidity through family office development promotion.

Digital Finance

Hong Kong stands at a historic juncture in the global digital finance revolution. To consolidate and enhance Hong Kong's leading position as an international financial center, we must seize the enormous opportunities brought by virtual assets with greater determination, more innovative thinking, and more decisive action.

This proposal integrates profound industry insights and forward-thinking perspectives, aiming to present a dual-track parallel strategy that balances market development while maintaining prudent regulation. Our core objective is to build Hong Kong into the world's safest, most dynamic, and most developmentally promising virtual asset center, becoming not only the preferred destination for global compliant capital and top talent, but also the leading city for next-generation digital finance.

We recommend that the Policy Address outline Hong Kong's virtual asset development blueprint through four strategic pillars: "Build Foundation, Attract Capital, Cultivate Talent, and Create Scenarios."

Part I: Build Foundation — Establishing a Globally Leading "Trustworthy" Regulatory Foundation

Objective: Construct a clear, unified, efficient, and flexible regulatory framework that makes "Hong Kong compliance" a globally recognized exemplary standard.

Implement Unified Regulatory Platform under "LEAP" Framework:

- Establish SFC as Single Window: Unify all virtual asset trading (including on-exchange and over-the-counter) and custody service license applications, regulatory communications, and daily supervision under the Securities and Futures Commission as the core processor. This will significantly simplify processes, reduce corporate compliance costs, and optimize the business environment.

- Strengthen Seamless Coordination between HKMA and SFC: Establish normalized joint working groups to ensure seamless integration between stablecoin regulation and trading platform regulation in data sharing, risk assessment, and joint enforcement, conveying unified and coordinated regulatory messages to the market.

- Maintain High Standards while Retaining Flexibility: Firmly implement new regulations without principled transition periods to demonstrate determination. However, provide a 6-month "interim permit period" for institutions already operating and actively applying for licenses to ensure smooth market transition.

Upgrade Technical Risk Management and Investor Protection Systems:

- Establish "Digital Asset Research and Education Center": Government-funded with industry participation, both popularizing virtual asset knowledge to the public and enhancing risk prevention awareness, while monitoring global market dynamics and providing forward-looking research and best practice guidance for regulatory authorities and the industry.

- Comprehensively Promote RegTech: Encourage and subsidize licensed institutions to adopt automated risk monitoring, anti-money laundering (AML), and counter-terrorism financing (CFT) tools, making this a consideration factor in license approval to enhance industry-wide compliance efficiency and standards.

- Establish "Digital Asset Security Alliance": Government-led, uniting cybersecurity companies, custody institutions, and trading platforms to establish threat intelligence sharing and emergency response mechanisms, jointly preventing major security risks such as hacker attacks and smart contract vulnerabilities.

Part II: Attract Capital — Attempting to Attract Global Investors with Hong Kong's Safe and Free Regulatory Mechanisms

Objective: Adopt highly competitive business strategies, taking proactive action to attract global top platforms, capital, and projects to Hong Kong.

Launch "VASP Excellence Partner Programme":

- Establish "Fintech Facilitation Commissioner": Assign dedicated service officers to international top-tier platforms intending to establish presence. The core responsibility of these officers is "facilitating business development" rather than traditional regulatory enforcement, proactively assisting enterprises in resolving license applications, compliance improvements, product innovation, and other issues, striving to shorten license approval cycles to within 90 days.

- Provide Strong Economic Incentives:

- Tax Benefits: Provide half profits tax reduction for the first two years for qualified virtual asset businesses.

- Direct Government Investment: Establish "Web3.0 Industry Development Fund," considering small equity investments (such as no more than 10%) in international top-tier platforms establishing Asia-Pacific headquarters in Hong Kong, and providing initial operating cost (rent, personnel) subsidies, sending the strongest government support signal.

Pioneer "Regulatory Mutual Recognition" and "Cross-border Sandbox" New Models:

- Launch Regulatory Passporting Negotiations: Actively engage in dialogue with jurisdictions with similar regulatory philosophies such as Singapore, UAE, and Switzerland, exploring establishment of bilateral or multilateral "regulatory mutual recognition" mechanisms, allowing Hong Kong licensed institutions to enter counterpart markets more conveniently and vice versa, greatly reducing enterprises' global compliance costs.

- Expand Cross-border Regulatory Sandbox: Allow innovative products (such as RWA, derivatives) tested by international platforms in Hong Kong sandbox to simultaneously obtain temporary permits from partner jurisdictions, addressing cross-border innovation pain points. Enterprises participating in sandbox can receive administrative benefits such as first-year license fee exemptions.

Part III: Cultivate Talent — Promoting Web3.0 Talent Attraction to Hong Kong

Objective: Employ a two-pronged approach, both attracting global top talent and accelerating cultivation of local talent, providing continuous intellectual support for industry development.

Launch "Web3.0 Visa" Program:

- Establish a fast track independent of existing talent schemes. Applicants need not meet traditional salary or asset thresholds; they can obtain three-year work visas if meeting any of the following conditions, with spouses and children also enjoying local resident treatment: 1) Former core executive of global leading virtual asset platforms; 2) Led development of decentralized applications with 100,000+ users; 3) Hold blockchain core technology patents.

Implement "Local Talent Genetic Modification" Project:

- Popularize University Web3.0 Education: Promote local universities to include blockchain, cryptoeconomics, and other courses in mandatory curricula for related disciplines such as finance and computer science.

- Host World-class Industry Summits: Government-led, in cooperation with InvestHK, strive to bring world-class industry summits such as Token2049 and Consensus to Hong Kong, creating Asia's Web3.0 thought exchange center.

- Implement "Finance X Web3.0 Executive Matching" Program: Government-funded subsidies encouraging traditional financial institution executives and local Web3.0 entrepreneurs to engage in regular exchange and learning for three months, breaking cognitive barriers and promoting deep integration of traditional finance with innovative genes.

Part IV: Create Scenarios — Government-led Creation of Real Application Scenarios

Objective: Go beyond financial trading, with government leading integration of virtual asset technology into real economy and social life, creating real, high-quality demand and assets for the market.

Launch "Public Asset Tokenization (RWA)" Pilot Program:

- Issue Tokenized Green Bonds and Infrastructure Bonds: Government-led, issue portions of green bonds or major infrastructure project bonds in tokenized form, allowing public subscription and secondary market trading on licensed trading platforms.

- Explore Public Asset Revenue Rights Tokenization: Research tokenizing future revenue rights of certain Urban Renewal Authority projects, rental revenue rights of government properties, etc., providing stable, high-quality RWA products for the market and establishing industry benchmarks.

- Reference international experience, formulate "Qualified RWA List," and provide tax exemptions for related innovative products to attract international capital.

Promote Virtual Asset Applications in Public Services:

- Pilot Stablecoin Fee Payment: Select certain government fees (such as business registration fees, taxes) for pilots, allowing citizens and enterprises to use HKMA-approved licensed stablecoins for payment.

- Support Cultural Arts NFT Issuance: Encourage institutions such as West Kowloon Cultural District and museums to issue their collections or tickets in NFT form and trade on compliant platforms, promoting Hong Kong as Asia's digital cultural arts hub.

Conclusion

Chief Executive, historical experience proves that Hong Kong's success lies in our ability to grasp the pulse of the times, courage to innovate, and embrace change. Currently, virtual assets represent the next wave we must seize. Through implementing the interconnected three-dimensional strategy of "Build Foundation, Attract Capital, Cultivate Talent, and Create Scenarios," Hong Kong can not only effectively manage risks but also take proactive action to stand out in the fierce global competition of digital finance. We firmly believe that with appropriate policies and strong implementation, Hong Kong will certainly be able to continue its position as an international financial center.

Green Finance

I. Background and Challenges

According to the "Global Green Finance Index 2024," Hong Kong ranks only 37th among global green finance cities, far behind international financial centers like London and Singapore. Meanwhile, Hong Kong's renewable energy generation accounts for only about 1% ("Hong Kong Energy Statistics Annual Report 2022"), significantly lower than London (40%) and New York (20%). Additionally, corporate greenwashing risks are increasingly severe, with 57% of investors suspecting greenwashing behavior in their investment portfolios, seriously undermining market trust. Facing global competition in climate action and green finance, Hong Kong urgently needs breakthrough policies.

II. Core Policy Recommendations

A. Accelerate New Energy Development: Achieve 15% Renewable Energy Target by 2035

- Establish Long-term Power Purchase Agreement (PPA) Mechanism

- Reference UK and New York pricing, set PPA price at HK$1.2 per kWh (HK$1,200 per MWh), providing HK$3.1 billion annual stable income for 1 GW offshore wind projects.

- Prioritize development of three major sea areas: Southeast Hong Kong (1,000 MW), Mirs Bay (500 MW), South Lamma Island (300 MW).

- Provide Fiscal and Tax Support

- Implement 10-year profits tax exemption for wind, solar, and energy storage projects (referencing Singapore's 5-15 year tax incentives).

- Government shares 30%-50% of submarine cable construction costs (accounting for 15%-20% of total project investment).

- Streamline Approval Processes