Discuss the pros and cons of the reforms to the regulations on reverse mergers for public listings

Release Date: 2023-08-06

Disclaimer and Notice

The information presented herein is intended solely for reference purposes and is of a general nature, not tailored to specific situations. It does not aim to encompass all relevant laws or regulations that may pertain to you or your business. Consequently, this content should not serve as a replacement for professional advice tailored to your individual circumstances. You and your business should refrain from relying solely on this material for decision-making. All copyrights and associated rights related to the information within this content are held by the Hong Kong Securities and Futures Professional Association.

Advantages and Disadvantages Following the Discussion on Shell Listing Regulation Reforms

In June 2018, the Hong Kong Stock Exchange initiated a consultation regarding the "shell listing" provisions within the Listing Rules. By July 2019, a summary of the consultation, addressing shell listings, continuous listing criteria, and various amendments to the Listing Rules, was published, with the relevant changes taking effect on October 1 of the same year. However, these modifications have faced criticism from various stakeholders, who argue that they adversely affect the growth of the Hong Kong securities market and may even impede the overall development of the Hong Kong economy.

What constitutes a "shell company"?

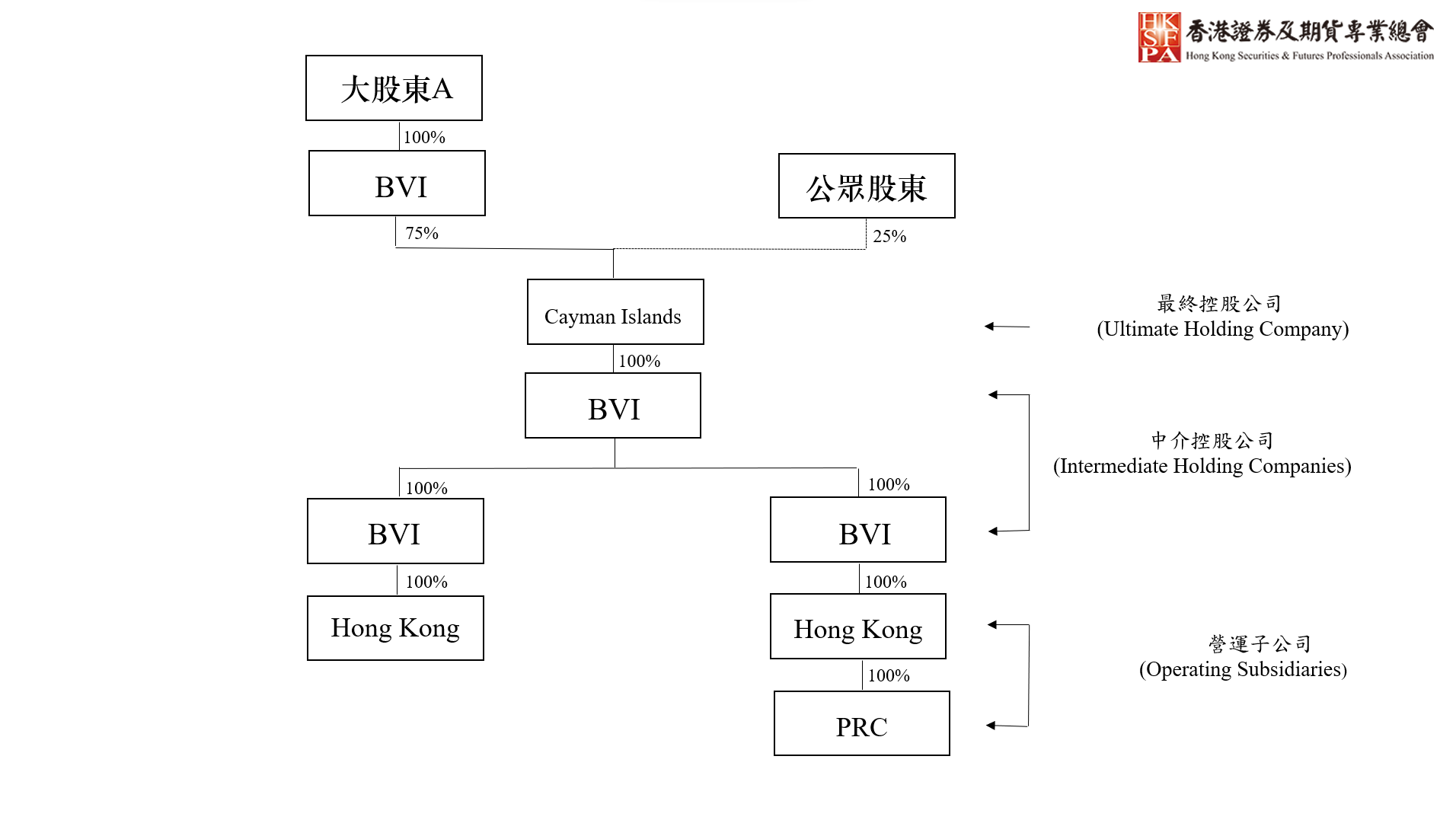

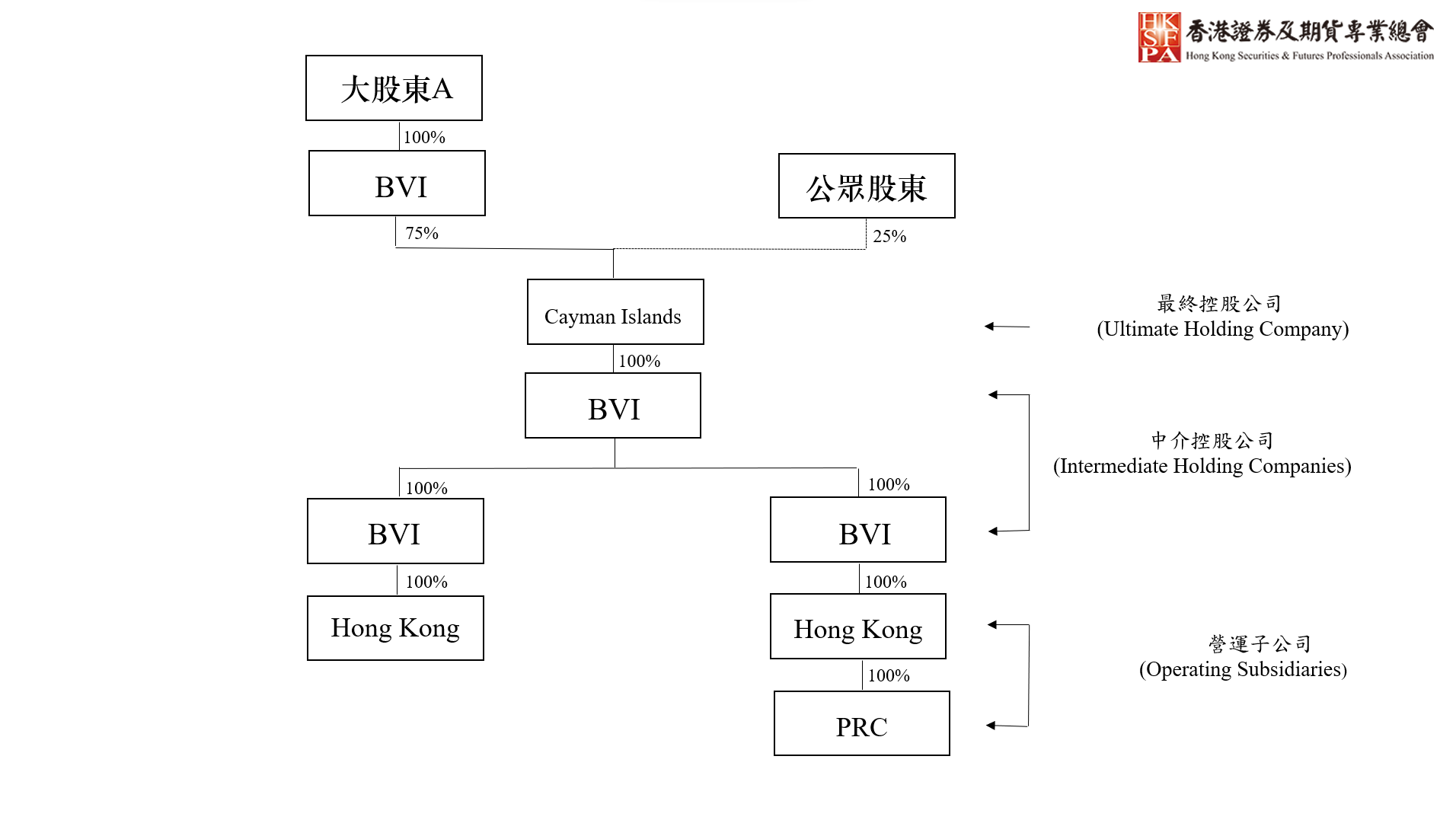

To gain a clearer understanding of what constitutes a "shell company," it is essential first to grasp the structure of a listed company. A listed company is not a standalone entity; rather, it comprises a conglomerate of multiple companies, often referred to as a "listed group." As depicted in the accompanying diagram, at the apex of this group structure, a major shareholder, referred to as Shareholder A, possesses a company registered in the Cayman Islands through a subsidiary based in the British Virgin Islands (BVI). At the base of this structure, several operating subsidiaries are engaged in tangible business activities, including processing trading orders, managing business partnerships, overseeing employee assets, and generating independent revenue streams. The intermediary layer consists of BVI companies that do not conduct actual business operations; these are classified as investment holding companies, commonly known as Intermediate Holding Companies. Within this framework, the Cayman Islands company acts as the ultimate holding company. Notably, approximately a decade ago, Bermuda companies were the preferred choice for ultimate holding companies, but in recent years, Cayman firms have gained prominence.

Which entities enjoy listing status under regulatory frameworks?

- Ultimate holding company

- Intermediate holding company

- Operating subsidiaries

- All of the above

The correct answer is A: Ultimate holding company. Ultimate holding companies are not involved in direct business operations, which is why they are termed "shell companies," while the corresponding operational entities are referred to as "fillings," specifically the operating subsidiaries. If the "filling" functions effectively and possesses high-quality assets, the overall valuation of the listed group is likely to increase. Conversely, if the "filling" is non-existent or of subpar quality, the entity is termed an "empty shell company."

If Shareholder A intends to pursue an Initial Public Offering (IPO), what steps must be taken?

The term "backdoor listing" typically carries negative implications, while "Front Door" signifies an Initial Public Offering (IPO). Should Shareholder A wish to execute an IPO, several preliminary considerations are necessary:

1. Implement a series of reorganizations, including the establishment of a Cayman Islands holding company, the formation of the listed group structure, and share conversions.

For private companies, the organizational structure is generally straightforward, with the owner directly controlling various subsidiaries. The intermediary structure seldom utilizes BVI companies, let alone the formation of a Cayman Islands entity. However, if an IPO is the goal, the primary objective is to initiate a comprehensive restructuring process to establish the requisite framework for a listed company, which includes creating a Cayman Islands or BVI company, converting shares, and reorganizing the business. This complexity raises questions about why a direct listing approach is not employed, as it involves numerous factors such as tax considerations, regulatory compliance, accounting practices, and operational flexibility.

2. Prepare listing documentation, including drafting the prospectus and Consolidated Financial Statements.

Upon completing the restructuring, including establishing holding companies, share conversions, and business reorganizations, it is time to compile listing documents such as the prospectus and Consolidated Financial Statements. The prospectus requires meticulous refinement and verification by professional writers and legal advisors. Additionally, the intended listed group must prepare Consolidated Financial Statements, necessitating the hiring of a Reporting Accountant for auditing purposes. The Hong Kong Stock Exchange mandates that qualified professionals be designated as Reporting Accountants, thereby increasing listing costs.

3. Engage a sponsor to conduct due diligence.

Selecting a sponsor is a critical phase in the listing journey. This sponsor undertakes due diligence throughout the entire listing process, examining all aspects from the company's inception to the day it goes public.

4. Submit listing documents to the Stock Exchange and the Securities and Futures Commission for approval.

After completing all prior steps, the next move is to submit the relevant documents to the Hong Kong Stock Exchange and the Securities and Futures Commission for approval. This phase is often time-consuming and labor-intensive, requiring responses to inquiries, submission of additional supporting materials, or amendments to the listing documents, all while navigating various challenges. If approved, the listing committee will endorse the application.

5. Upon successful approval, conduct the public offering and appoint underwriters to manage the shares.

Once approval is granted, the company can proceed with its public offering, and underwriters will take on the responsibility of attracting investors for the shares. Overall, the IPO preparation process is intricate, with stringent requirements imposed by the Stock Exchange and the Securities and Futures Commission regarding profitability and compliance. These conditions continue to evolve to safeguard investor interests. Meeting these requirements is a formidable challenge, compounded by the necessity to adhere to a comprehensive set of compliance procedures, including the various documents mentioned earlier. It is evident that every IPO requires the collaboration of a substantial professional team, with associated costs often reaching tens of millions of Hong Kong dollars, whether for main board or growth enterprise board listings.

So, how does "backdoor listing" function?

The previous sections have outlined the operational model of IPOs. However, is it limited only to newly established Cayman companies seeking to be traded on the stock market? In scenarios where shareholders identify an already listed Cayman Islands company, known as a "shell company," they can inject their business into it, effectively allowing the shareholder's company to go public. This raises the question of whether shareholders are exempt from the approval processes mandated by the Securities and Futures Commission or the Stock Exchange.

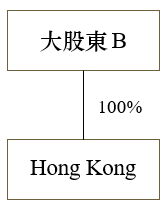

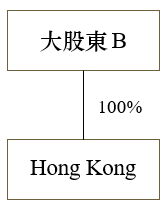

To effectively demonstrate this trading operation, consider the following example: Imagine that a significant shareholder, referred to as B, has complete ownership of a company based in Hong Kong, which is performing successfully in its business endeavors.

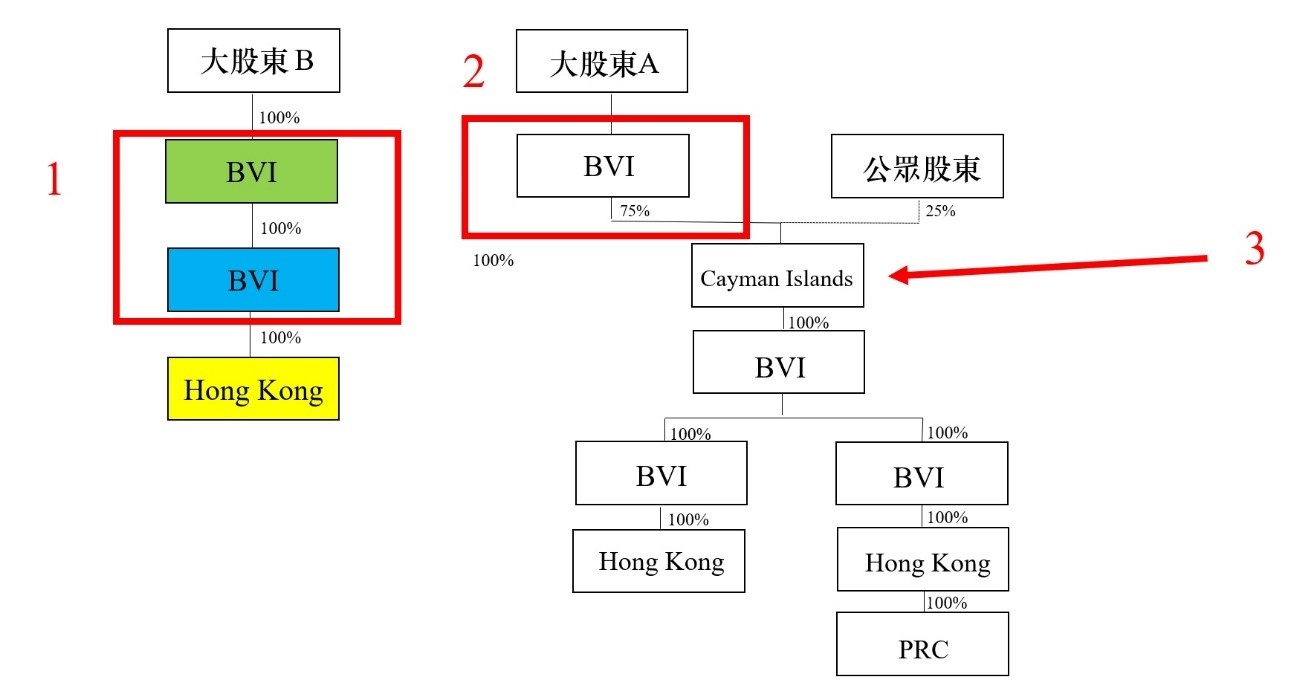

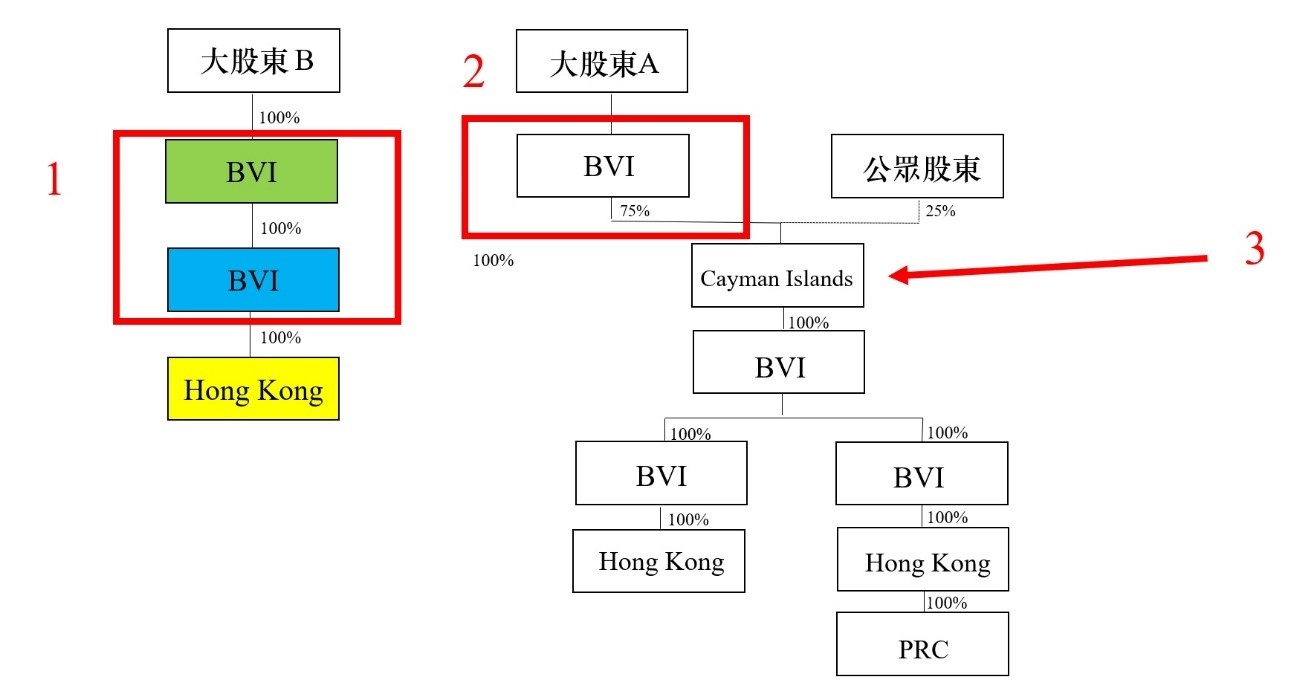

Following a series of restructuring initiatives, Major Shareholder B has established two British Virgin Islands (BVI) companies, primarily to circumvent stamp duty obligations. Concurrently, Major Shareholder B has proposed the integration of its business into a publicly listed Cayman Islands company owned by Major Shareholder A. Additionally, Major Shareholder A has initiated acquisition activities for this Cayman Islands entity, positioning itself as the acquirer, with the target being the business of a company affiliated with Major Shareholder B, which includes 100% of the equity. As a publicly listed entity, Major Shareholder A has the flexibility to utilize various payment methods, including the issuance of equivalent shares as consideration for the transaction. Upon completion of the share-based transaction, Major Shareholder B will maintain a significant majority of control over the BVI company. Consequently, Major Shareholder B will indirectly assume the role of the principal major shareholder of the Cayman Islands company, thereby possessing majority control.

The illustration above indicates that upon the completion of the transaction, major shareholder B will gain control over the listed company. The distinctive aspect of this transaction is that major shareholder A, originally the acquirer, has ultimately been acquired by major shareholder B. In accordance with the stock exchange's classification, this type of acquisition is termed a 'reverse takeover' rather than a 'backdoor listing.'

Is 'backdoor listing' considered a violation?

A: Yes

B: No

Answer: No.

In a summer 2018 interview with David Graham, then Head of Listing at the Hong Kong Stock Exchange (HKEX), it was clarified that such transactions are not illegal. Graham noted that while backdoor listings are not entirely prohibited, adherence to all listing requirements, including those related to suitability, is essential.

In June 2018, the HKEX initiated a consultation on amending the Listing Rules concerning backdoor listings. By July 2019, a summary of the revisions was published, addressing backdoor listings, ongoing listing criteria, and other amendments. These changes, effective from October 1, 2019, established the regulatory framework for backdoor listings.

The rules regarding "reverse takeovers" encompass:

- Provisions in Chapter 14 of the Listing Rules

- Guidance letter HKEX-GL104-19 on reverse takeovers

- Guidance letter HKEX-GL105-19 on large-scale securities issuances

For backdoor listings, Chapter 14 offers relevant guidelines. Furthermore, two guidance letters address rules on reverse takeovers and large-scale securities issuances, highlighting their connection to backdoor listings.

Per Rule 14.54(1) of the Listing Rules:

- The acquisition target must meet suitability (Rule 8.04) and business record period requirements (Rules 8.05, 8.05A, or 8.05B).

- The enlarged group must fulfill all new listing criteria of Chapter 8, excluding Rule 8.05.

If the HKEX and the Securities and Futures Commission (SFC) classify an acquisition as a backdoor listing, it is treated as a "reverse takeover" and a new listing application. Consequently, the acquiring company must comply with new listing procedures, including appointing a sponsor and issuing listing documents. An additional prospectus and listing application fee are required. The acquisition target must demonstrate business and financial compliance, including achieving a profit of at least HKD 20 million in the previous year. This process, though it does not necessitate market fundraising, still involves stringent regulatory approval.

Regarding "shell" companies, Rule 14.54(2) mandates that if a listed company lacks sufficient business operations (Rule 13.24(1)), the acquisition target must meet Rule 8.07 requirements. This ensures sufficient public interest in the acquisition, which can be proven through public offerings or other evidence. The current shareholder base alone is inadequate.

If an acquisition target is deemed a shell company, it must demonstrate sufficient public interest, akin to public offering requirements, as specified in Rule 14.54(2).

Defining a "Reverse Takeover"

Rule 14.06B – Principle-based Test

A "reverse takeover" occurs when a listed company acquires assets in a manner aimed at listing the acquisition target while circumventing Chapter 8's new applicant requirements. This principle-based test requires careful transaction analysis to ensure compliance.

The exchange evaluates factors such as:

- Acquisition scale relative to the company

- Fundamental changes in the company's business

- Nature and scale of business pre- and post-acquisition

- Quality of the acquisition target

- Changes in company control

- Transactions aimed at listing the acquisition target

These criteria enable the exchange to determine whether a "reverse takeover" is involved.

Listing Rules Section 14.06B Note 2 – Bright Line Tests

These circumstances have raised serious concerns within the industry, prompting inquiries such as: Can definitive boundaries or criteria be established for "takeover defense actions," thereby identifying violations once a certain benchmark is reached? The Stock Exchange clarifies that the Listing Rules incorporate a precise Bright Line Test, indicating that when the specified conditions are met, it constitutes a takeover defense action.

The Bright Line Test delineates that: (1) If a series of acquisitions results in a change of control of the company—similar to the earlier example—where others acquire equity through a substantial number of new shares or convertible bonds, effectively replacing major shareholder A with major shareholder B, it signifies a violation. However, market participants may attempt to gradually inject assets post-acquisition to circumvent this issue. (2) Acquisitions occurring within 36 months following a change in control, under an agreement or understanding with those who gained control prior to this period, will also be classified as a takeover defense action.

If the 'anti-takeover action' does not involve acquisition matters, the Listing Rules are also regulated.

The Listing Rules further address situations not involving acquisitions under Listing Rules Section 14.06D—which includes significant investor subscriptions to the listed company's securities to gain control or substantial influence, followed by the company utilizing the proceeds to acquire or develop unrelated new businesses, thereby circumventing new listing requirements. These actions imply a shift in control and the initiation of new business ventures.

Moreover, as per Listing Rules Section 14.06D, if a listed company raises capital through various fundraising avenues and engages in new businesses unrelated to its original operations, the Stock Exchange will enforce stringent regulations.

Listing Rules Section 14.06E imposes restrictions on the sale or distribution of the majority of a listed company’s existing business within 36 months of a change in control unless the remaining or acquired assets conform to Listing Rules Section 8.05 (or Sections 8.05A or 8.05B).

Additionally, Listing Rules Section 14.06E mandates that if shareholders sell the assets of the original business within 36 months, the Stock Exchange will enforce strict regulations.

This section complements the clear tests for "takeover defense actions" outlined in Section 14.06B Note 2, preventing investors from deliberately structuring transactions to evade scrutiny by first acquiring new businesses before divesting existing ones. This clause also extends to scenarios where a listed company creates new businesses post-change in control to operate them through the listed entity, circumventing new listing mandates. Since these arrangements do not encompass acquisition matters, reliance solely on Listing Rules Section 14.06B is insufficient.

The Stock Exchange has established these rules primarily because the 36-month look-back period is referenced in the second clause of the Bright Line Test, likely anticipating market attempts to reorder transactions to bypass the listing rules and thus preemptively closing these loopholes.

Concerns arise regarding whether these regulations will inhibit smaller listed companies from pursuing mergers and acquisitions or hinder underperforming companies in sunset industries from making necessary acquisitions to improve their situations. In an era where diversification is a prevalent growth strategy and technological advancements compel industry transformations, the question remains: will legitimate corporate actions aimed at shedding unprofitable divisions or fostering transformation be misinterpreted as "shell stock activities" and unjustly penalized?

Furthermore, the discretion granted to the Stock Exchange may introduce regulatory uncertainties.

While the Stock Exchange has acknowledged these concerns, no changes have been implemented thus far. To strike a balance, the Exchange has proposed new measures, including "extreme transactions."

"Extreme transactions" are defined as instances where an individual or series of asset acquisitions (alone or in conjunction with other transactions or arrangements) achieves a listing effect for the acquisition target under "principle-based tests," provided that the listed company can demonstrate no intent to evade new listing requirements. Such transactions may thus be categorized as "extreme transactions" as articulated in Listing Rules Section 14.06C.

If a listed company exhibits characteristics of a "shell stock," its transactions will not qualify as extreme transactions, as the rules governing "takeover defense actions" aim to preclude the trading or acquisition of "listed shell stocks" to attain a shell listing.

The Stock Exchange will evaluate cases individually based on specific circumstances to determine if the requirements for "extreme transactions" are satisfied. To qualify, the listed company must demonstrate not only an absence of intent to evade new listing requirements but also adhere to additional criteria:

A general benchmark may include listed companies reporting annual revenue or total asset values of HKD 1 billion or more, as per the latest financial statements. In evaluating the scale, the Stock Exchange will also consider the company's financial health, the nature and operational model of the business, and future business strategies. For instance, a company achieving the HKD 1 billion revenue threshold but possessing minimal net worth (or even net liabilities) and functioning as an order-trading entity may not pass the test.

Several conditions must be satisfied: (1) Control of the listed company must remain unchanged prior to completing the proposed transaction. (2) If the transaction amount exceeds HKD 1 billion and the company's business is of substantial scale, any further acquisitions will be classified as "extreme transactions."

Listing Rules Section 14.06C(2) necessitates:

Even if the Stock Exchange designates the transaction as "extreme transactions," the acquisition target must still fulfill the profit test outlined in Chapter 8, which mandates a continuous profit record for three years, aligning with regulations governing shell listings.

The listed company must furnish sufficient information to the Stock Exchange to validate that the acquisition target complies with Listing Rules Sections 8.04 and 8.05 (or Sections 8.05A or 8.05B). This information should include crucial details in the draft circular, such as an accountant's report for the acquisition target during the record period, business and management explanations, risk factors, compliance with laws, and other requisite information.

Listing Rules Section 14.53A mandates that listed companies appoint financial advisors to conduct due diligence on the acquisition target and submit statements in the prescribed format outlined in Appendix 29 of the Listing Rules (similar to sponsor statements).

Furthermore, although the acquirer is not obligated to provide a prospectus, the circular that must be published requires extensive content, including an accountant's report, detailed business and management explanations, and disclosures regarding risks and compliance. These disclosure requirements parallel those in a prospectus. While hiring a sponsor is not mandatory, the financial advisor's responsibilities mirror those of a sponsor, requiring submissions to the Stock Exchange akin to initial IPO work.

Conclusion

In conclusion, engaging in "extreme transactions" entails navigating numerous challenges and procedural hurdles, as these concepts—"shell activities" and "shell listings"—defy clear definition. Additionally, many gray areas exist within empty shells and shell stock transactions. The stance of the Stock Exchange and the Securities and Futures Commission tends to adopt a strict "guilty until proven innocent" approach, necessitating that companies intending to avoid shell activities or listings provide evidence to the Stock Exchange and await its confirmation before receiving exemptions.

This methodology is presently contentious, as it is unjust to categorize all engaged in shell listings as bad actors or to presume that all small shareholders in shell stocks are complicit in fraudulent activities. Some reputable companies have successfully listed through shell structures, including Geely Automobile (00175.HK), CITIC Limited (00267.HK), and PCCW (00008.HK). Thus, how should this issue be defined? The Stock Exchange’s view that shell listing activities are inherently undesirable stems from concerns about potentially listing companies with significant issues. While this position is understandable, the Exchange's blanket approach to enforcement adversely affects legitimate business activities.

For small shareholders, there exists hope that underperforming small-cap companies can achieve acquisitions through "shell listings," providing exit strategies. However, the revised Stock Exchange rules not only challenge the survival of these small and medium enterprises but also exacerbate the difficulties faced by underperforming companies seeking to revitalize their operations, simultaneously limiting exit opportunities for small shareholders. This situation appears contradictory, given the Stock Exchange's frequent emphasis on protecting small shareholder interests. The amendments to the Listing Rules indirectly pressure the viability of small and medium-sized enterprises, failing to recognize the diligent operations of these companies in Hong Kong. Certain policies seem to target smaller market cap entities, continuously raising listing thresholds and requirements. For small enterprises already listed, they should not face policy intervention based solely on their business conditions or commercial practices, provided they do not deceive small shareholder interests.

The reality is that numerous existing issues in Hong Kong's listing rules require improvement, as many companies are opting to list in the U.S. and Indonesia, leading to a significant loss of listing business for Hong Kong. Alterations in listing rules directly impact small and medium enterprises in Hong Kong, ultimately affecting the livelihoods of millions. It is imperative for the Stock Exchange to conduct a thorough review and consider relaxing listing rules to invigorate the sluggish Hong Kong economy.

Mofiz Chan

Chairman

Hong Kong Securities and Futures Professionals Association

The information presented herein is intended solely for reference purposes and is of a general nature, not tailored to specific situations. It does not aim to encompass all relevant laws or regulations that may pertain to you or your business. Consequently, this content should not serve as a replacement for professional advice tailored to your individual circumstances. You and your business should refrain from relying solely on this material for decision-making. All copyrights and associated rights related to the information within this content are held by the Hong Kong Securities and Futures Professional Association.

Advantages and Disadvantages Following the Discussion on Shell Listing Regulation Reforms

In June 2018, the Hong Kong Stock Exchange initiated a consultation regarding the "shell listing" provisions within the Listing Rules. By July 2019, a summary of the consultation, addressing shell listings, continuous listing criteria, and various amendments to the Listing Rules, was published, with the relevant changes taking effect on October 1 of the same year. However, these modifications have faced criticism from various stakeholders, who argue that they adversely affect the growth of the Hong Kong securities market and may even impede the overall development of the Hong Kong economy.

What constitutes a "shell company"?

To gain a clearer understanding of what constitutes a "shell company," it is essential first to grasp the structure of a listed company. A listed company is not a standalone entity; rather, it comprises a conglomerate of multiple companies, often referred to as a "listed group." As depicted in the accompanying diagram, at the apex of this group structure, a major shareholder, referred to as Shareholder A, possesses a company registered in the Cayman Islands through a subsidiary based in the British Virgin Islands (BVI). At the base of this structure, several operating subsidiaries are engaged in tangible business activities, including processing trading orders, managing business partnerships, overseeing employee assets, and generating independent revenue streams. The intermediary layer consists of BVI companies that do not conduct actual business operations; these are classified as investment holding companies, commonly known as Intermediate Holding Companies. Within this framework, the Cayman Islands company acts as the ultimate holding company. Notably, approximately a decade ago, Bermuda companies were the preferred choice for ultimate holding companies, but in recent years, Cayman firms have gained prominence.

Which entities enjoy listing status under regulatory frameworks?

- Ultimate holding company

- Intermediate holding company

- Operating subsidiaries

- All of the above

The correct answer is A: Ultimate holding company. Ultimate holding companies are not involved in direct business operations, which is why they are termed "shell companies," while the corresponding operational entities are referred to as "fillings," specifically the operating subsidiaries. If the "filling" functions effectively and possesses high-quality assets, the overall valuation of the listed group is likely to increase. Conversely, if the "filling" is non-existent or of subpar quality, the entity is termed an "empty shell company."

If Shareholder A intends to pursue an Initial Public Offering (IPO), what steps must be taken?

The term "backdoor listing" typically carries negative implications, while "Front Door" signifies an Initial Public Offering (IPO). Should Shareholder A wish to execute an IPO, several preliminary considerations are necessary:

1. Implement a series of reorganizations, including the establishment of a Cayman Islands holding company, the formation of the listed group structure, and share conversions.

For private companies, the organizational structure is generally straightforward, with the owner directly controlling various subsidiaries. The intermediary structure seldom utilizes BVI companies, let alone the formation of a Cayman Islands entity. However, if an IPO is the goal, the primary objective is to initiate a comprehensive restructuring process to establish the requisite framework for a listed company, which includes creating a Cayman Islands or BVI company, converting shares, and reorganizing the business. This complexity raises questions about why a direct listing approach is not employed, as it involves numerous factors such as tax considerations, regulatory compliance, accounting practices, and operational flexibility.

2. Prepare listing documentation, including drafting the prospectus and Consolidated Financial Statements.

Upon completing the restructuring, including establishing holding companies, share conversions, and business reorganizations, it is time to compile listing documents such as the prospectus and Consolidated Financial Statements. The prospectus requires meticulous refinement and verification by professional writers and legal advisors. Additionally, the intended listed group must prepare Consolidated Financial Statements, necessitating the hiring of a Reporting Accountant for auditing purposes. The Hong Kong Stock Exchange mandates that qualified professionals be designated as Reporting Accountants, thereby increasing listing costs.

3. Engage a sponsor to conduct due diligence.

Selecting a sponsor is a critical phase in the listing journey. This sponsor undertakes due diligence throughout the entire listing process, examining all aspects from the company's inception to the day it goes public.

4. Submit listing documents to the Stock Exchange and the Securities and Futures Commission for approval.

After completing all prior steps, the next move is to submit the relevant documents to the Hong Kong Stock Exchange and the Securities and Futures Commission for approval. This phase is often time-consuming and labor-intensive, requiring responses to inquiries, submission of additional supporting materials, or amendments to the listing documents, all while navigating various challenges. If approved, the listing committee will endorse the application.

5. Upon successful approval, conduct the public offering and appoint underwriters to manage the shares.

Once approval is granted, the company can proceed with its public offering, and underwriters will take on the responsibility of attracting investors for the shares. Overall, the IPO preparation process is intricate, with stringent requirements imposed by the Stock Exchange and the Securities and Futures Commission regarding profitability and compliance. These conditions continue to evolve to safeguard investor interests. Meeting these requirements is a formidable challenge, compounded by the necessity to adhere to a comprehensive set of compliance procedures, including the various documents mentioned earlier. It is evident that every IPO requires the collaboration of a substantial professional team, with associated costs often reaching tens of millions of Hong Kong dollars, whether for main board or growth enterprise board listings.

So, how does "backdoor listing" function?

The previous sections have outlined the operational model of IPOs. However, is it limited only to newly established Cayman companies seeking to be traded on the stock market? In scenarios where shareholders identify an already listed Cayman Islands company, known as a "shell company," they can inject their business into it, effectively allowing the shareholder's company to go public. This raises the question of whether shareholders are exempt from the approval processes mandated by the Securities and Futures Commission or the Stock Exchange.

To effectively demonstrate this trading operation, consider the following example: Imagine that a significant shareholder, referred to as B, has complete ownership of a company based in Hong Kong, which is performing successfully in its business endeavors.

Following a series of restructuring initiatives, Major Shareholder B has established two British Virgin Islands (BVI) companies, primarily to circumvent stamp duty obligations. Concurrently, Major Shareholder B has proposed the integration of its business into a publicly listed Cayman Islands company owned by Major Shareholder A. Additionally, Major Shareholder A has initiated acquisition activities for this Cayman Islands entity, positioning itself as the acquirer, with the target being the business of a company affiliated with Major Shareholder B, which includes 100% of the equity. As a publicly listed entity, Major Shareholder A has the flexibility to utilize various payment methods, including the issuance of equivalent shares as consideration for the transaction. Upon completion of the share-based transaction, Major Shareholder B will maintain a significant majority of control over the BVI company. Consequently, Major Shareholder B will indirectly assume the role of the principal major shareholder of the Cayman Islands company, thereby possessing majority control.

The illustration above indicates that upon the completion of the transaction, major shareholder B will gain control over the listed company. The distinctive aspect of this transaction is that major shareholder A, originally the acquirer, has ultimately been acquired by major shareholder B. In accordance with the stock exchange's classification, this type of acquisition is termed a 'reverse takeover' rather than a 'backdoor listing.'

Is 'backdoor listing' considered a violation?

A: Yes

B: No

Answer: No.

In a summer 2018 interview with David Graham, then Head of Listing at the Hong Kong Stock Exchange (HKEX), it was clarified that such transactions are not illegal. Graham noted that while backdoor listings are not entirely prohibited, adherence to all listing requirements, including those related to suitability, is essential.

In June 2018, the HKEX initiated a consultation on amending the Listing Rules concerning backdoor listings. By July 2019, a summary of the revisions was published, addressing backdoor listings, ongoing listing criteria, and other amendments. These changes, effective from October 1, 2019, established the regulatory framework for backdoor listings.

The rules regarding "reverse takeovers" encompass:

- Provisions in Chapter 14 of the Listing Rules

- Guidance letter HKEX-GL104-19 on reverse takeovers

- Guidance letter HKEX-GL105-19 on large-scale securities issuances

For backdoor listings, Chapter 14 offers relevant guidelines. Furthermore, two guidance letters address rules on reverse takeovers and large-scale securities issuances, highlighting their connection to backdoor listings.

Per Rule 14.54(1) of the Listing Rules:

- The acquisition target must meet suitability (Rule 8.04) and business record period requirements (Rules 8.05, 8.05A, or 8.05B).

- The enlarged group must fulfill all new listing criteria of Chapter 8, excluding Rule 8.05.

If the HKEX and the Securities and Futures Commission (SFC) classify an acquisition as a backdoor listing, it is treated as a "reverse takeover" and a new listing application. Consequently, the acquiring company must comply with new listing procedures, including appointing a sponsor and issuing listing documents. An additional prospectus and listing application fee are required. The acquisition target must demonstrate business and financial compliance, including achieving a profit of at least HKD 20 million in the previous year. This process, though it does not necessitate market fundraising, still involves stringent regulatory approval.

Regarding "shell" companies, Rule 14.54(2) mandates that if a listed company lacks sufficient business operations (Rule 13.24(1)), the acquisition target must meet Rule 8.07 requirements. This ensures sufficient public interest in the acquisition, which can be proven through public offerings or other evidence. The current shareholder base alone is inadequate.

If an acquisition target is deemed a shell company, it must demonstrate sufficient public interest, akin to public offering requirements, as specified in Rule 14.54(2).

Defining a "Reverse Takeover"

Rule 14.06B – Principle-based Test

A "reverse takeover" occurs when a listed company acquires assets in a manner aimed at listing the acquisition target while circumventing Chapter 8's new applicant requirements. This principle-based test requires careful transaction analysis to ensure compliance.

The exchange evaluates factors such as:

- Acquisition scale relative to the company

- Fundamental changes in the company's business

- Nature and scale of business pre- and post-acquisition

- Quality of the acquisition target

- Changes in company control

- Transactions aimed at listing the acquisition target

These criteria enable the exchange to determine whether a "reverse takeover" is involved.

Listing Rules Section 14.06B Note 2 – Bright Line Tests

- An asset acquisition, or a series of acquisitions, is deemed highy significant if it results in a change of control over a listed company, excluding its subsidiaries. This may occur during the acquisition process by the listed company or as a consequence of the acquisition itself.

- Additionaly, an asset acquisition is considered highly significant under the following conditions: if it occurs within 36 months following a change in control of the listed company (excluding its subsidiaries), and if the assets are acquired from an individual or group that gained control through an agreement, arrangement, or memorandum of understanding. In such cases, whether the acquisitions are viewed individually or collectively, they are classified as highly significant.

These circumstances have raised serious concerns within the industry, prompting inquiries such as: Can definitive boundaries or criteria be established for "takeover defense actions," thereby identifying violations once a certain benchmark is reached? The Stock Exchange clarifies that the Listing Rules incorporate a precise Bright Line Test, indicating that when the specified conditions are met, it constitutes a takeover defense action.

The Bright Line Test delineates that: (1) If a series of acquisitions results in a change of control of the company—similar to the earlier example—where others acquire equity through a substantial number of new shares or convertible bonds, effectively replacing major shareholder A with major shareholder B, it signifies a violation. However, market participants may attempt to gradually inject assets post-acquisition to circumvent this issue. (2) Acquisitions occurring within 36 months following a change in control, under an agreement or understanding with those who gained control prior to this period, will also be classified as a takeover defense action.

If the 'anti-takeover action' does not involve acquisition matters, the Listing Rules are also regulated.

The Listing Rules further address situations not involving acquisitions under Listing Rules Section 14.06D—which includes significant investor subscriptions to the listed company's securities to gain control or substantial influence, followed by the company utilizing the proceeds to acquire or develop unrelated new businesses, thereby circumventing new listing requirements. These actions imply a shift in control and the initiation of new business ventures.

Moreover, as per Listing Rules Section 14.06D, if a listed company raises capital through various fundraising avenues and engages in new businesses unrelated to its original operations, the Stock Exchange will enforce stringent regulations.

Listing Rules Section 14.06E imposes restrictions on the sale or distribution of the majority of a listed company’s existing business within 36 months of a change in control unless the remaining or acquired assets conform to Listing Rules Section 8.05 (or Sections 8.05A or 8.05B).

Additionally, Listing Rules Section 14.06E mandates that if shareholders sell the assets of the original business within 36 months, the Stock Exchange will enforce strict regulations.

This section complements the clear tests for "takeover defense actions" outlined in Section 14.06B Note 2, preventing investors from deliberately structuring transactions to evade scrutiny by first acquiring new businesses before divesting existing ones. This clause also extends to scenarios where a listed company creates new businesses post-change in control to operate them through the listed entity, circumventing new listing mandates. Since these arrangements do not encompass acquisition matters, reliance solely on Listing Rules Section 14.06B is insufficient.

The Stock Exchange has established these rules primarily because the 36-month look-back period is referenced in the second clause of the Bright Line Test, likely anticipating market attempts to reorder transactions to bypass the listing rules and thus preemptively closing these loopholes.

- Coud this pose challenges for smaller publicly listed companies when they pursue mergers and acquisitions?

- Might it compicate the ability of underperforming listed companies or those in declining industries to make acquisitions aimed at revitalizing their operations?

- In today's market, diversifying business operations is a widey adopted strategy for growth, particularly as technological advancements compel numerous industries to evolve. If publicly listed companies choose to divest from unprofitable ventures, initiate transformations, or explore new avenues for diversification, could these initiatives be misinterpreted as "shell stock activities" and face undue penalties?

- Additionaly, does providing excessive discretion to the stock exchange create an atmosphere of regulatory uncertainty?

Concerns arise regarding whether these regulations will inhibit smaller listed companies from pursuing mergers and acquisitions or hinder underperforming companies in sunset industries from making necessary acquisitions to improve their situations. In an era where diversification is a prevalent growth strategy and technological advancements compel industry transformations, the question remains: will legitimate corporate actions aimed at shedding unprofitable divisions or fostering transformation be misinterpreted as "shell stock activities" and unjustly penalized?

Furthermore, the discretion granted to the Stock Exchange may introduce regulatory uncertainties.

While the Stock Exchange has acknowledged these concerns, no changes have been implemented thus far. To strike a balance, the Exchange has proposed new measures, including "extreme transactions."

"Extreme transactions" are defined as instances where an individual or series of asset acquisitions (alone or in conjunction with other transactions or arrangements) achieves a listing effect for the acquisition target under "principle-based tests," provided that the listed company can demonstrate no intent to evade new listing requirements. Such transactions may thus be categorized as "extreme transactions" as articulated in Listing Rules Section 14.06C.

If a listed company exhibits characteristics of a "shell stock," its transactions will not qualify as extreme transactions, as the rules governing "takeover defense actions" aim to preclude the trading or acquisition of "listed shell stocks" to attain a shell listing.

The Stock Exchange will evaluate cases individually based on specific circumstances to determine if the requirements for "extreme transactions" are satisfied. To qualify, the listed company must demonstrate not only an absence of intent to evade new listing requirements but also adhere to additional criteria:

- Prior to the proposed transaction, contro of the listed company must have remained unchanged for a significant duration (typically no less than 36 months) under the influence of individual persons or a group, and the transaction must not result in a change in control; in this assessment, the Stock Exchange will reference factors under "principle-based tests" concerning "changes in control or substantial control"; or

- The primary business of the isted company must be of considerable scale, and the company should continue to operate this primary business post-transaction.

A general benchmark may include listed companies reporting annual revenue or total asset values of HKD 1 billion or more, as per the latest financial statements. In evaluating the scale, the Stock Exchange will also consider the company's financial health, the nature and operational model of the business, and future business strategies. For instance, a company achieving the HKD 1 billion revenue threshold but possessing minimal net worth (or even net liabilities) and functioning as an order-trading entity may not pass the test.

Several conditions must be satisfied: (1) Control of the listed company must remain unchanged prior to completing the proposed transaction. (2) If the transaction amount exceeds HKD 1 billion and the company's business is of substantial scale, any further acquisitions will be classified as "extreme transactions."

Listing Rules Section 14.06C(2) necessitates:

- The acquisition target must adhere to isting suitability provisions (Listing Rules Section 8.04) and operational record provisions (Listing Rules Section 8.05 or 8.05A or 8.05B); and

- The enarged group must comply with all new listing requirements of Chapter 8 of the Listing Rules (except for Section 8.05).

Even if the Stock Exchange designates the transaction as "extreme transactions," the acquisition target must still fulfill the profit test outlined in Chapter 8, which mandates a continuous profit record for three years, aligning with regulations governing shell listings.

The listed company must furnish sufficient information to the Stock Exchange to validate that the acquisition target complies with Listing Rules Sections 8.04 and 8.05 (or Sections 8.05A or 8.05B). This information should include crucial details in the draft circular, such as an accountant's report for the acquisition target during the record period, business and management explanations, risk factors, compliance with laws, and other requisite information.

Listing Rules Section 14.53A mandates that listed companies appoint financial advisors to conduct due diligence on the acquisition target and submit statements in the prescribed format outlined in Appendix 29 of the Listing Rules (similar to sponsor statements).

Furthermore, although the acquirer is not obligated to provide a prospectus, the circular that must be published requires extensive content, including an accountant's report, detailed business and management explanations, and disclosures regarding risks and compliance. These disclosure requirements parallel those in a prospectus. While hiring a sponsor is not mandatory, the financial advisor's responsibilities mirror those of a sponsor, requiring submissions to the Stock Exchange akin to initial IPO work.

Conclusion

In conclusion, engaging in "extreme transactions" entails navigating numerous challenges and procedural hurdles, as these concepts—"shell activities" and "shell listings"—defy clear definition. Additionally, many gray areas exist within empty shells and shell stock transactions. The stance of the Stock Exchange and the Securities and Futures Commission tends to adopt a strict "guilty until proven innocent" approach, necessitating that companies intending to avoid shell activities or listings provide evidence to the Stock Exchange and await its confirmation before receiving exemptions.

This methodology is presently contentious, as it is unjust to categorize all engaged in shell listings as bad actors or to presume that all small shareholders in shell stocks are complicit in fraudulent activities. Some reputable companies have successfully listed through shell structures, including Geely Automobile (00175.HK), CITIC Limited (00267.HK), and PCCW (00008.HK). Thus, how should this issue be defined? The Stock Exchange’s view that shell listing activities are inherently undesirable stems from concerns about potentially listing companies with significant issues. While this position is understandable, the Exchange's blanket approach to enforcement adversely affects legitimate business activities.

For small shareholders, there exists hope that underperforming small-cap companies can achieve acquisitions through "shell listings," providing exit strategies. However, the revised Stock Exchange rules not only challenge the survival of these small and medium enterprises but also exacerbate the difficulties faced by underperforming companies seeking to revitalize their operations, simultaneously limiting exit opportunities for small shareholders. This situation appears contradictory, given the Stock Exchange's frequent emphasis on protecting small shareholder interests. The amendments to the Listing Rules indirectly pressure the viability of small and medium-sized enterprises, failing to recognize the diligent operations of these companies in Hong Kong. Certain policies seem to target smaller market cap entities, continuously raising listing thresholds and requirements. For small enterprises already listed, they should not face policy intervention based solely on their business conditions or commercial practices, provided they do not deceive small shareholder interests.

The reality is that numerous existing issues in Hong Kong's listing rules require improvement, as many companies are opting to list in the U.S. and Indonesia, leading to a significant loss of listing business for Hong Kong. Alterations in listing rules directly impact small and medium enterprises in Hong Kong, ultimately affecting the livelihoods of millions. It is imperative for the Stock Exchange to conduct a thorough review and consider relaxing listing rules to invigorate the sluggish Hong Kong economy.

Mofiz Chan

Chairman

Hong Kong Securities and Futures Professionals Association

Latest Advocacy Papers

Opinion letter of 2026-27 Budget

2026-01-19