Feedback on the 2023-24 Budget

Release Date: 2023-01-27

Financial Secretary Paul Chan, GBM, GBS, MH, JP

2 Tim Mei Avenue, Central, Hong Kong

24th Floor, Government Headquarters

Budget Consultation Support Group

budget@fstb.gov.hk

January 27, 2023

Dear Secretary Chan,

2 Tim Mei Avenue, Central, Hong Kong

24th Floor, Government Headquarters

Budget Consultation Support Group

budget@fstb.gov.hk

January 27, 2023

Dear Secretary Chan,

Feedback on the 2023-24 Budget

On behalf of the Hong Kong Securities and Futures Professionals Association, committed to patriotism and representing our industry, we present the following insights regarding the 2023-24 Budget. We hope these considerations will aid in shaping the budget to enhance the economic policies of both China and Hong Kong for sustainable and progressive growth.

1. Tourism and Consumption: As the pandemic wanes and economic recovery emerges, tourist numbers in Hong Kong remain below one-tenth of pre-pandemic figures. Many citizens face unemployment or severe wage reductions, leading to rapid depletion of savings. We urge the government to continue issuing consumption vouchers to invigorate the local consumer market and support citizens' livelihoods. We recognize the importance of prudent government spending and propose narrowing the distribution to permanent residents of Hong Kong.

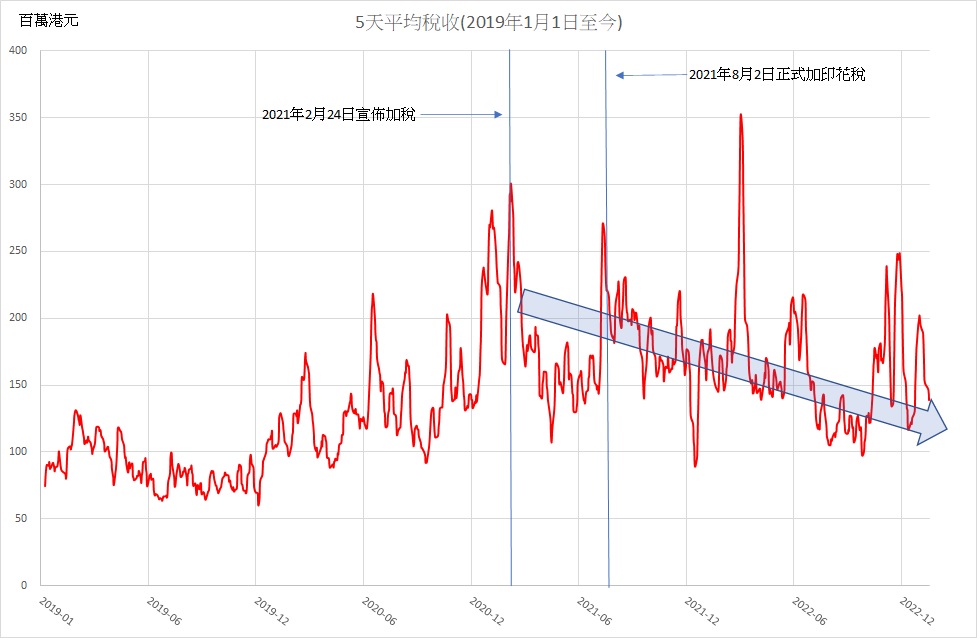

2. Stock Stamp Duty: We recommend reinstating or abolishing the stock stamp duty rate to enhance the competitiveness of the Hong Kong market, ensuring it does not exceed the general industry commission rate.

3. Risk Management Guidelines: We oppose the Securities and Futures Commission’s Consultation Paper on Proposed Risk Management Guidelines for Licensed Persons Dealing in Futures Contracts, which could impede the growth of Hong Kong's futures market and contradict its role as a risk management hub in the 14th Five-Year Plan. It's crucial that Hong Kong's risk management framework emphasizes quality without being overly corrective, fostering genuine development as a risk management center.

4. Securities Industry Blueprint: Following the release of the development strategy blueprint for the Hong Kong insurance sector, we advocate for a similar strategic plan for the securities industry, aligned with our nation's dual circulation development strategy, to enable forward planning.

5. Virtual Assets Development: While supporting the government's initiative to develop virtual assets, it is vital to account for technical and industry risks, assessing their impact on the retail market thoroughly. The recent collapse of the major cryptocurrency exchange FTX serves as a cautionary example. We emphasize the need for strengthened education and regulatory measures to prevent speculative excesses that could damage Hong Kong’s reputation as a financial center. A prudent approach is essential.

For any inquiries regarding this letter, please feel free to contact me (Phone: / Email: ) or Mr. Wong Hoi-lok, Head of the Concerned Industry Department (Phone: / Email: ).

Wishing you a prosperous Spring Festival,

Mofiz Chan

Chairman

Hong Kong Securities and Futures Professionals Association

The chart displays the 5-day average trend in tax revenue from the stock stamp duty over the period from January 2019 to December 2022. Notably, two red lines highlight significant dates: the announcement of the tax increase on February 24, 2021, and the implementation of this increase on August 2, 2021.

Latest Advocacy Papers

Opinion letter of 2026-27 Budget

2026-01-19